Understanding the Value of Your Belongings: A Guide to House Contents Calculators

Related Articles: Understanding the Value of Your Belongings: A Guide to House Contents Calculators

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding the Value of Your Belongings: A Guide to House Contents Calculators. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Value of Your Belongings: A Guide to House Contents Calculators

In the event of a fire, flood, or other unforeseen disaster, the financial consequences can be devastating. Beyond the physical damage to your home, the loss of your personal belongings – furniture, electronics, clothing, artwork, and more – can be emotionally and financially crippling. This is where understanding the true value of your household contents becomes crucial.

A house contents value calculator is a powerful tool that helps homeowners determine the monetary worth of their possessions. It provides a comprehensive assessment of your belongings, allowing you to accurately calculate the amount of insurance coverage you need. This information is invaluable for several reasons:

The Importance of Accurate Valuation:

- Adequate Insurance Coverage: Underinsured homeowners may face significant financial hardship if a disaster strikes. A calculator helps ensure you have sufficient coverage to replace or repair your belongings, minimizing the financial burden during a difficult time.

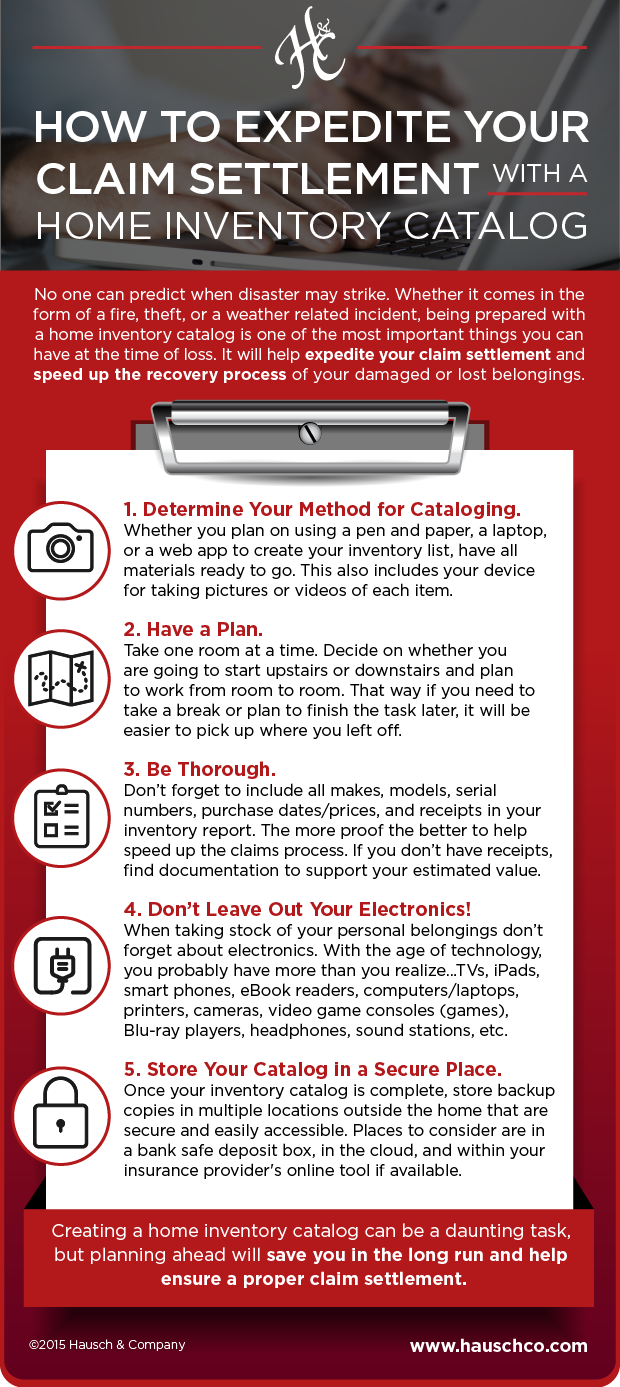

- Negotiating with Insurance Companies: Having a detailed inventory of your possessions with their estimated values strengthens your position when dealing with insurance claims. This documentation can help expedite the claims process and ensure you receive fair compensation for your losses.

- Peace of Mind: Knowing the value of your belongings provides a sense of security and preparedness. You can rest assured that you are financially protected in the event of an unexpected event.

How House Contents Value Calculators Work:

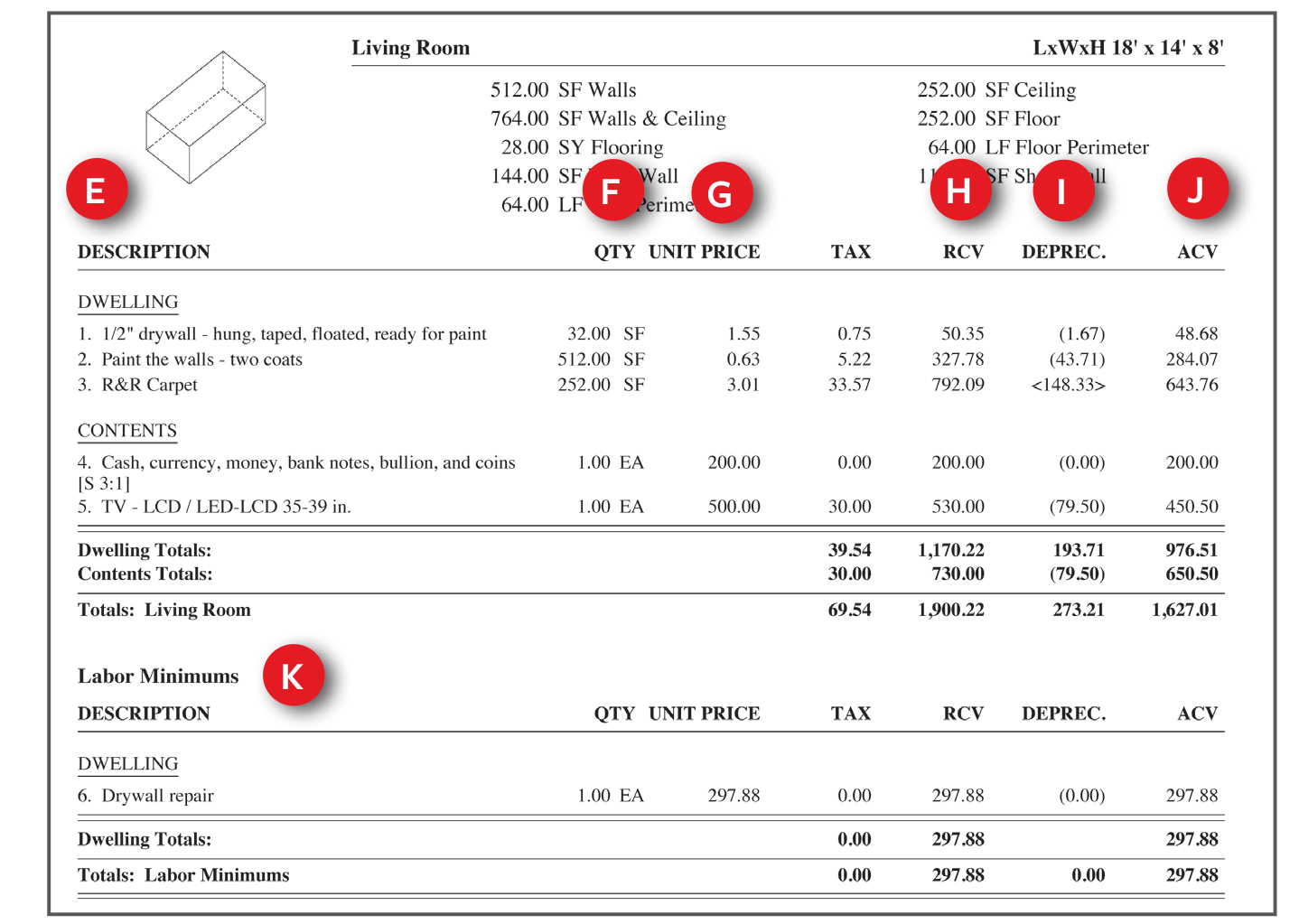

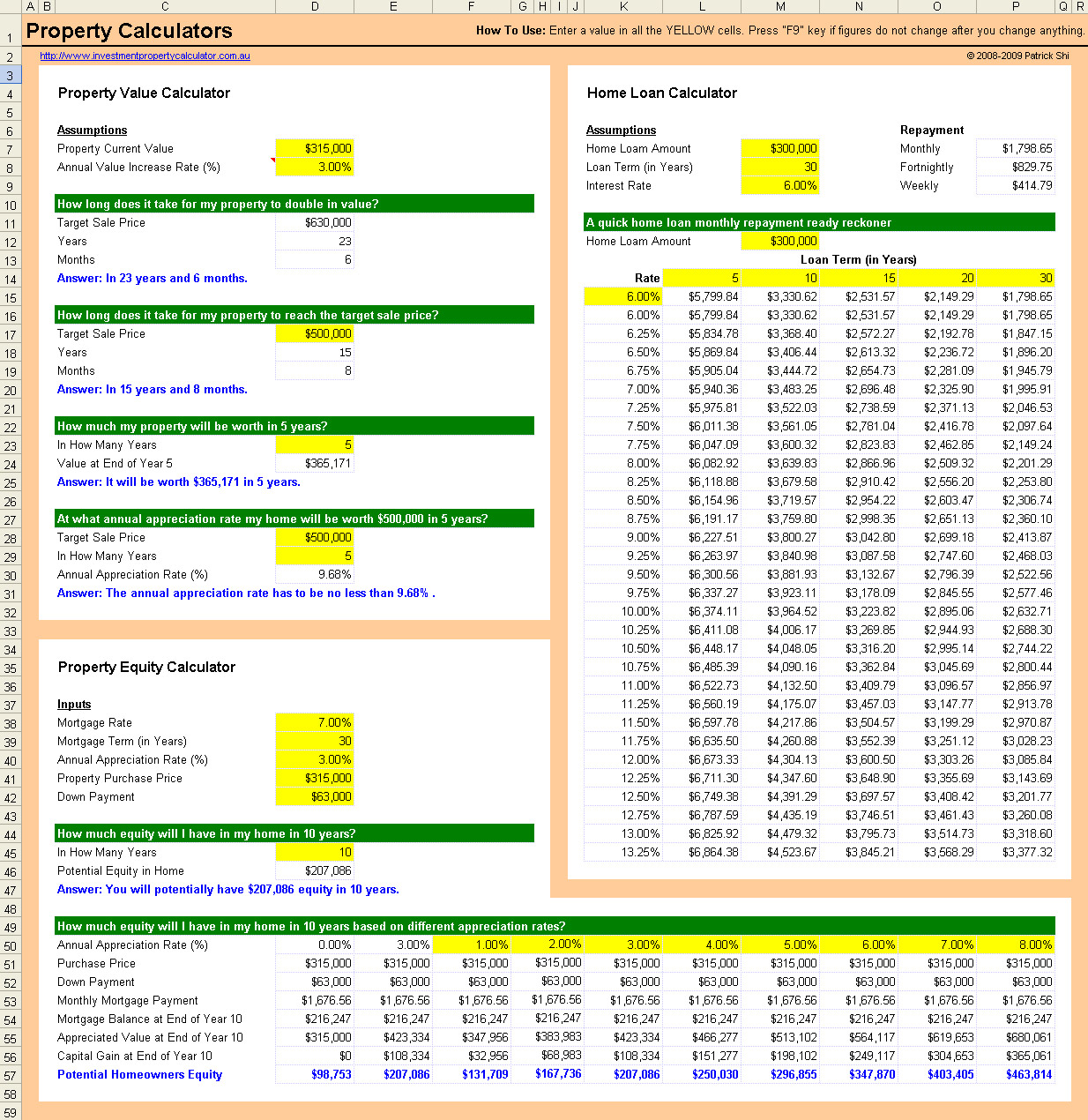

These calculators utilize various methods to estimate the value of your possessions. Common approaches include:

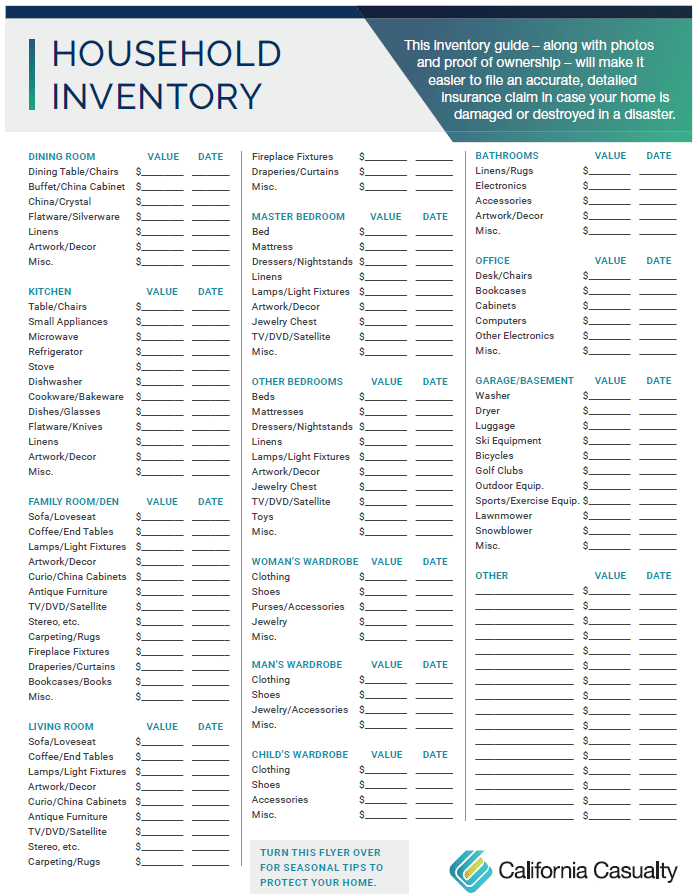

- Room-by-Room Inventory: Calculators prompt you to list items in each room of your home, allowing you to categorize and value them. This method is highly detailed and provides a comprehensive assessment.

- Pre-Set Item Categories: Some calculators offer pre-defined categories like "furniture," "electronics," or "clothing." You simply select the appropriate category and input the number of items. While less detailed, this method is quicker and easier for basic estimations.

- Replacement Cost Value: Most calculators utilize this method, which estimates the cost of replacing your belongings with similar items in today’s market. This ensures you receive sufficient coverage to replace lost or damaged items at current prices.

- Depreciation Calculation: Some calculators incorporate depreciation, factoring in the age and condition of your possessions. This provides a more realistic valuation that reflects the actual value of your belongings.

Beyond the Calculator: Tips for Accurate Valuation:

- Detailed Inventory: Create a comprehensive inventory of your belongings, including descriptions, purchase dates, and receipts. This documentation is essential for insurance claims.

- Photos and Videos: Take detailed photos and videos of your possessions, especially valuable items like jewelry, artwork, or antiques. This visual evidence can be invaluable when filing claims.

- Appraisals: For high-value items like jewelry, antiques, or collectibles, consider obtaining professional appraisals. These documents provide expert valuations that are accepted by insurance companies.

- Regular Updates: Your belongings change over time. Update your inventory and valuations regularly to ensure your insurance coverage remains accurate.

Frequently Asked Questions:

Q: What information do I need to use a house contents value calculator?

A: You will typically need information about your home, such as the number of rooms, square footage, and the age of your belongings. You may also need to provide details about specific items, including their purchase price, condition, and any unique features.

Q: Are house contents value calculators accurate?

A: While calculators provide a good estimate, they are not a substitute for professional appraisals. The accuracy of a calculator depends on the information you provide and the specific methods used. It is always recommended to double-check the estimated values and consult with a qualified appraiser for high-value items.

Q: How often should I update my house contents value?

A: It is recommended to update your inventory and valuations at least annually, or more frequently if you make significant purchases or changes to your belongings.

Q: What if I have items that are difficult to value?

A: For items that are difficult to value, such as antiques, collectibles, or artwork, consider consulting with a professional appraiser. They can provide an objective assessment of the value of your belongings.

Conclusion:

A house contents value calculator is a powerful tool for homeowners seeking to protect their financial well-being. It provides a comprehensive assessment of your belongings, ensuring you have adequate insurance coverage and peace of mind. By utilizing the information provided by these calculators, homeowners can make informed decisions about their insurance needs and prepare for the unexpected. Remember, accurate valuations are essential for navigating the complexities of insurance claims and ensuring you receive fair compensation for your losses.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Value of Your Belongings: A Guide to House Contents Calculators. We hope you find this article informative and beneficial. See you in our next article!