The Role of Probate in Estate Administration: Navigating the Transfer of Property

Related Articles: The Role of Probate in Estate Administration: Navigating the Transfer of Property

Introduction

With great pleasure, we will explore the intriguing topic related to The Role of Probate in Estate Administration: Navigating the Transfer of Property. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Role of Probate in Estate Administration: Navigating the Transfer of Property

Probate is a legal process that occurs after a person dies, designed to ensure the orderly transfer of their assets to their beneficiaries. This process involves identifying the deceased’s assets, paying any outstanding debts, and distributing the remaining assets according to the terms of their will or the laws of intestacy.

Understanding the scope of probate is crucial for individuals planning their estates and for beneficiaries seeking to inherit assets. This article will delve into the intricate relationship between probate and the transfer of property, exploring the various types of property encompassed within the probate process and highlighting the importance of proper estate planning to avoid potential complications.

What Types of Property are Subject to Probate?

Probate encompasses a wide range of assets, including:

Real Estate: This includes any land owned by the deceased, along with any structures built upon it, such as homes, apartments, or commercial buildings.

Personal Property: This category encompasses a wide array of items, including:

- Tangible assets: Furniture, jewelry, vehicles, artwork, collectibles, and other physical possessions.

- Intangible assets: Bank accounts, stocks, bonds, retirement accounts, life insurance policies, and intellectual property.

Determining Probate’s Applicability:

Not all property is automatically subject to probate. The process is triggered when the deceased owned assets in their own name, individually, or as a joint tenant with rights of survivorship. In cases where the deceased owned property jointly with another person, with rights of survivorship, the surviving joint owner typically inherits the property automatically, bypassing probate.

The Importance of Probate in Property Transfer:

Probate plays a critical role in ensuring the legal transfer of property after death. It serves several crucial functions:

- Verification of Ownership: Probate establishes the deceased’s rightful ownership of the assets, preventing disputes and ensuring that the designated beneficiaries receive their rightful inheritance.

- Debt Settlement: Probate allows for the identification and settlement of any outstanding debts owed by the deceased, ensuring that creditors are paid before any remaining assets are distributed.

- Legal Distribution: Probate ensures that assets are distributed according to the deceased’s wishes, as outlined in their will, or according to the laws of intestacy if no will exists.

Navigating the Probate Process:

The probate process can be complex and time-consuming, varying in duration and complexity depending on the size and nature of the estate.

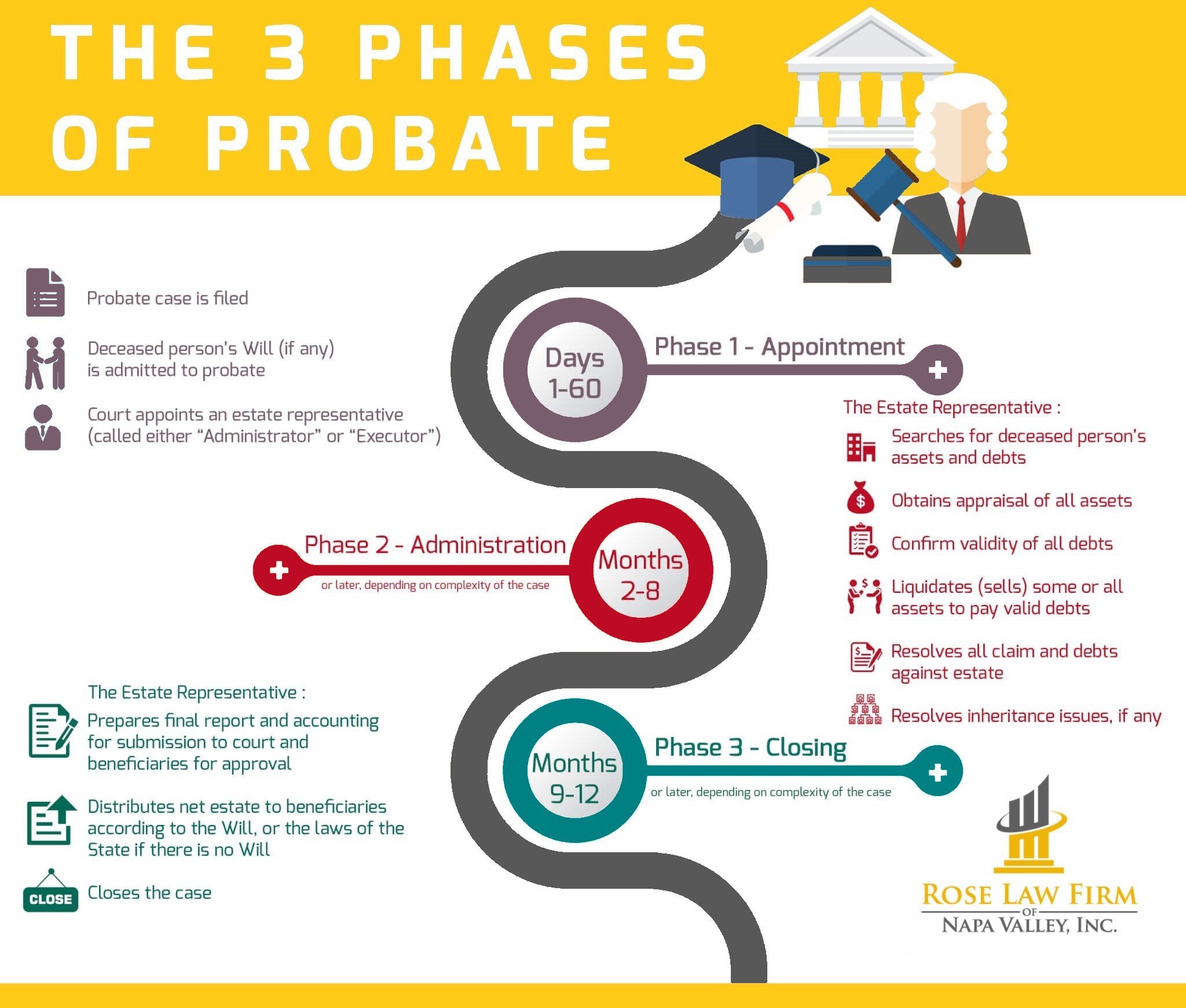

Key Steps in Probate:

- Petition for Probate: A petition is filed with the court, initiating the process.

- Appointment of Executor or Administrator: A designated executor (as per the will) or an administrator (appointed by the court) is responsible for managing the estate.

- Asset Inventory and Valuation: All assets are identified, appraised, and documented.

- Debt Settlement: Outstanding debts are paid from the estate’s assets.

- Distribution of Assets: Remaining assets are distributed to beneficiaries according to the will or intestacy laws.

The Role of Estate Planning:

Effective estate planning can significantly simplify the probate process and reduce the potential for disputes and delays.

Key Estate Planning Strategies:

- Creating a Will: A will outlines the distribution of the deceased’s assets and designates an executor to manage the estate.

- Establishing a Trust: A trust can be used to hold assets and distribute them according to the grantor’s wishes, often avoiding probate entirely.

- Joint Ownership with Rights of Survivorship: Property held jointly with another person, with rights of survivorship, passes directly to the surviving owner upon death, bypassing probate.

- Beneficiary Designations: Assets such as life insurance policies, retirement accounts, and bank accounts can be designated with specific beneficiaries, avoiding probate for these assets.

Frequently Asked Questions (FAQs) about Probate and Property:

1. Does Probate Apply to All Property?

No, probate does not apply to all property. Assets held jointly with rights of survivorship, assets with beneficiary designations, and assets held in trusts typically bypass probate.

2. What Happens If There is No Will?

If a person dies without a will, their estate will be distributed according to the laws of intestacy. This may result in an unexpected distribution of assets, which can lead to disputes among family members.

3. How Long Does Probate Take?

The duration of probate varies significantly depending on the complexity of the estate, the jurisdiction, and the cooperation of involved parties. Simple estates can be settled within a few months, while complex estates can take years.

4. Can I Avoid Probate Entirely?

While avoiding probate entirely is not always possible, effective estate planning can minimize the need for probate by using strategies like trusts, joint ownership with rights of survivorship, and beneficiary designations.

5. What are the Costs Involved in Probate?

Probate costs can vary depending on the size and complexity of the estate, legal fees, and court fees. Estate planning can help mitigate these costs by minimizing the need for probate.

Tips for Avoiding Probate Complications:

- Create a Comprehensive Estate Plan: This includes a will, trust agreements, and beneficiary designations for all relevant assets.

- Keep Records Organized: Maintain clear documentation of all assets and financial accounts.

- Communicate with Beneficiaries: Ensure that beneficiaries understand the terms of the estate plan and their rights and responsibilities.

- Consult with an Estate Planning Attorney: Seek professional advice to ensure that your estate plan is properly structured and meets your specific needs.

Conclusion:

Probate is a fundamental process in estate administration, ensuring the legal transfer of property after death. It plays a crucial role in verifying ownership, settling debts, and distributing assets according to the deceased’s wishes. Understanding the intricacies of probate and its relationship to property ownership is essential for individuals planning their estates and for beneficiaries seeking to inherit assets. Effective estate planning, including wills, trusts, and beneficiary designations, can significantly minimize the need for probate and simplify the process of asset transfer. By proactively addressing estate planning needs, individuals can ensure a smooth transition of their assets, safeguarding the interests of their beneficiaries and minimizing potential complications.

/what-is-probate-3505244-v3-5c07e7f746e0fb0001693ecf-8f024a9ead024bc796f36a02e1880768.jpg)

Closure

Thus, we hope this article has provided valuable insights into The Role of Probate in Estate Administration: Navigating the Transfer of Property. We thank you for taking the time to read this article. See you in our next article!