The Probate Process: Understanding When a House Requires Legal Administration

Related Articles: The Probate Process: Understanding When a House Requires Legal Administration

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Probate Process: Understanding When a House Requires Legal Administration. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Probate Process: Understanding When a House Requires Legal Administration

The passing of a loved one often brings a wave of complex emotions alongside practical concerns. One such concern frequently arises: what happens to the deceased’s property, particularly their home? The answer often lies in the legal process known as probate. This article aims to illuminate the intricacies of probate, clarifying when it is necessary and its significance in the distribution of a deceased individual’s estate.

Probate: A Legal Framework for Estate Distribution

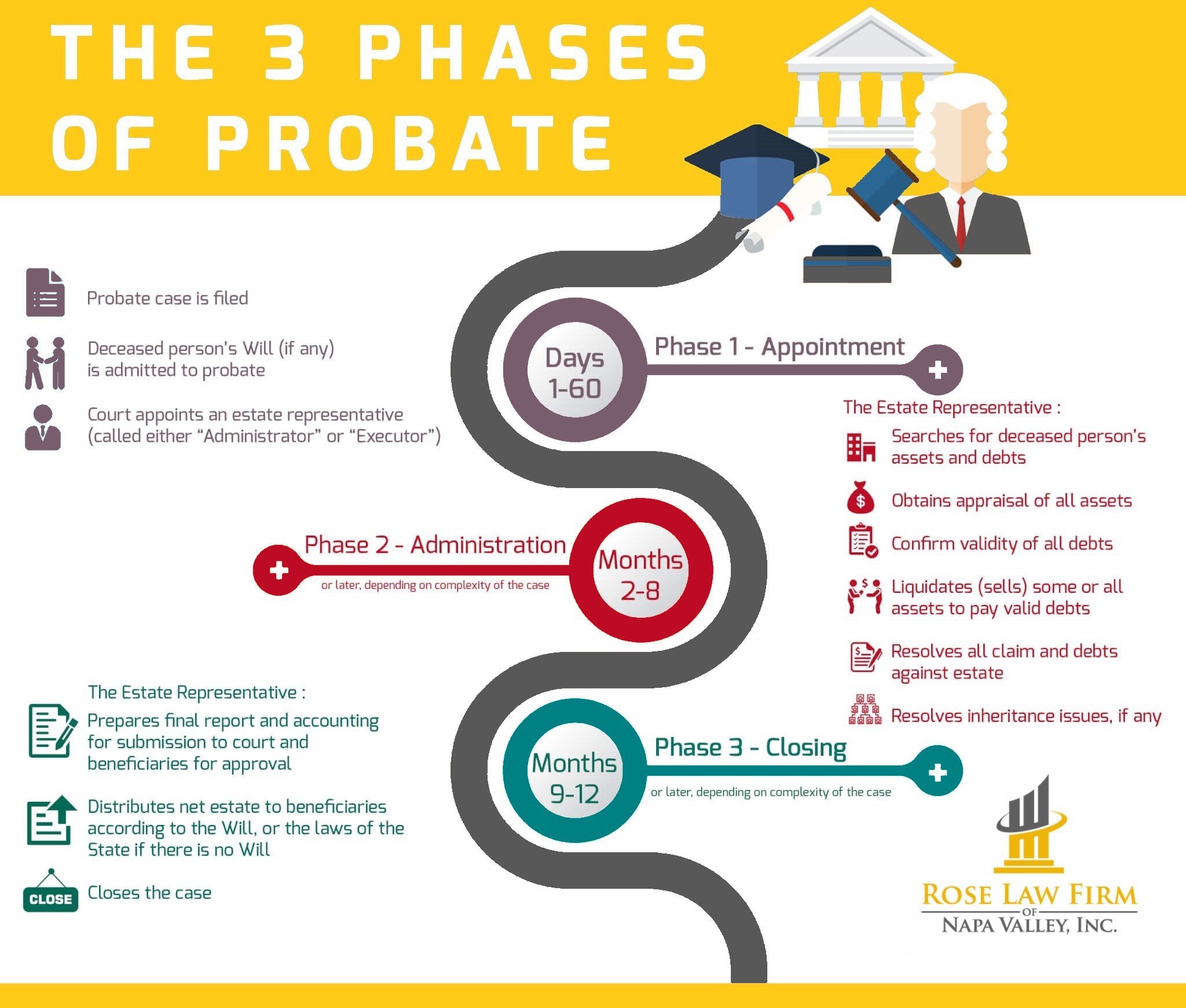

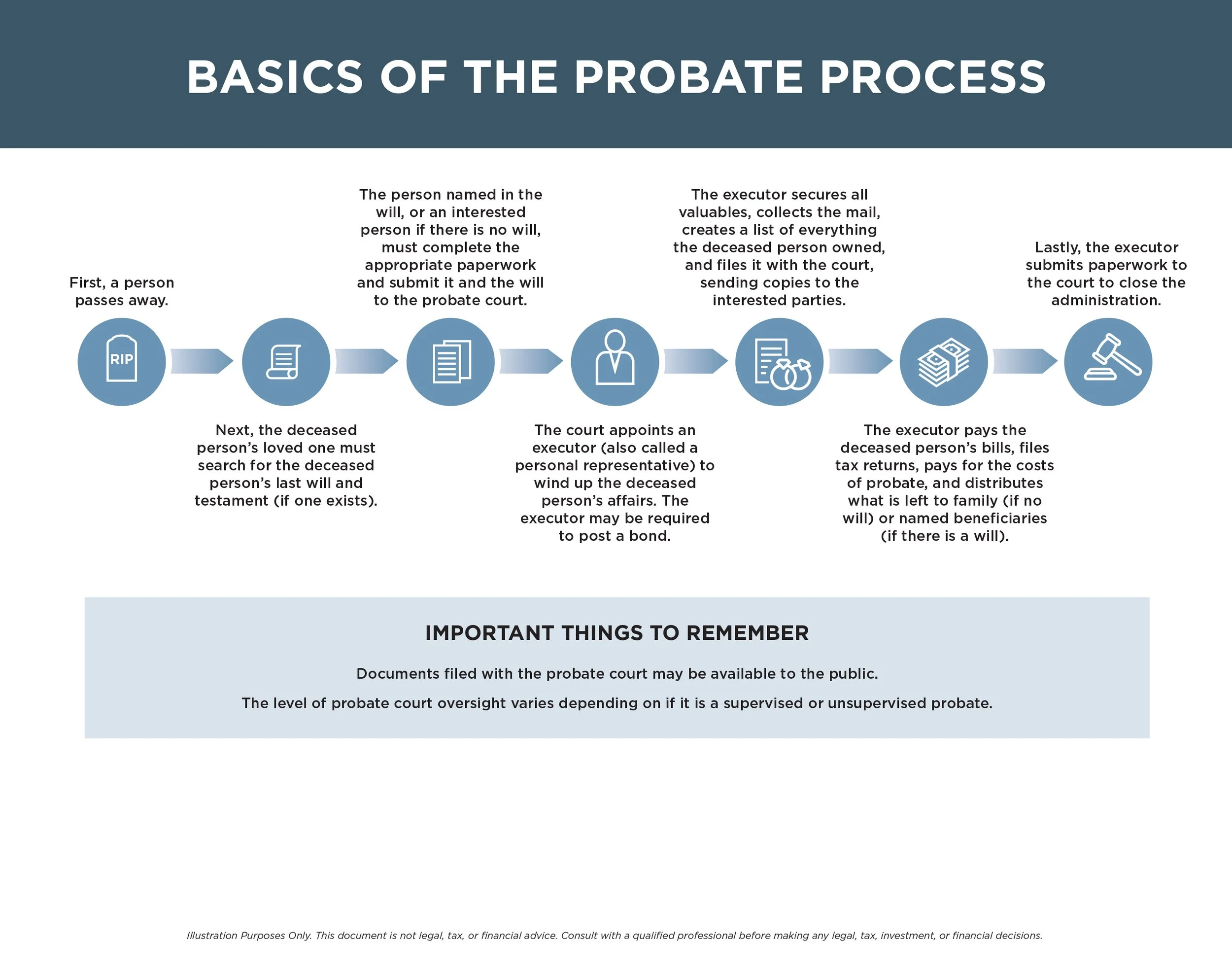

Probate is a legal process overseen by a court where the validity of a will is established, debts and taxes are settled, and the remaining assets are distributed to the designated beneficiaries. This process ensures a transparent and legally binding transfer of ownership, protecting the interests of both the deceased’s heirs and creditors.

When Probate is Necessary

The need for probate hinges on the legal status of the deceased’s assets and the presence of a valid will. A house, like any other asset, may require probate in the following scenarios:

- No Will: If the deceased did not leave a will, their property is distributed according to the laws of intestacy, which vary by jurisdiction. Probate becomes necessary to determine the legal heirs and facilitate the transfer of ownership.

- Joint Ownership with Rights of Survivorship: When a property is held jointly with rights of survivorship, the surviving owner automatically inherits the deceased’s interest. Probate is typically not required in such cases.

- Property Held in Trust: If the house is part of a trust, the trustee manages the distribution of assets according to the trust document. Probate may not be necessary for the house itself, but the trust may require its own probate process.

- Complex Estate: Even if a will exists, probate may be necessary if the estate is complex, involving multiple beneficiaries, substantial debt, or contested claims.

Benefits of Probate

While probate can be a time-consuming and potentially expensive process, it offers several crucial benefits:

- Legal Validity: Probate ensures the legal transfer of ownership, providing clear title and protecting beneficiaries from future disputes.

- Debt Settlement: The probate court facilitates the settlement of any outstanding debts, safeguarding the deceased’s estate from financial burdens.

- Tax Compliance: Probate helps in determining and paying any applicable inheritance taxes, ensuring compliance with legal requirements.

- Protection for Beneficiaries: Probate safeguards the interests of beneficiaries, ensuring fair and equitable distribution of assets according to the deceased’s wishes or the laws of intestacy.

Alternatives to Probate

In certain situations, alternatives to probate may be available, offering potential advantages in terms of time and cost:

- Small Estate Procedures: Some states offer simplified procedures for estates with limited assets, potentially reducing the need for full probate.

- Transfer on Death (TOD) Deeds: These deeds allow property to be transferred directly to a designated beneficiary upon the owner’s death, bypassing probate.

- Revocable Living Trusts: Establishing a living trust during one’s lifetime can transfer assets to the trust, avoiding probate upon death.

FAQs Regarding Probate and Real Estate

Q: What is the cost of probate?

A: Probate costs vary significantly depending on the complexity of the estate, location, and legal fees. Costs can include court filing fees, attorney fees, and executor fees.

Q: How long does probate take?

A: The duration of probate can range from a few months to several years, depending on the complexity of the estate and any potential challenges.

Q: Can a house be sold before probate is complete?

A: Generally, a house cannot be sold before probate is complete. However, the court may grant permission for a sale under certain circumstances.

Q: What happens if a house is not probated?

A: Failing to probate a house can lead to legal complications, such as title disputes, unpaid debts, and potential tax liabilities.

Tips for Avoiding Probate for a House

- Create a Will: A properly drafted will clearly outlines the distribution of assets, minimizing the need for probate.

- Consider Joint Ownership with Rights of Survivorship: This ensures the surviving owner automatically inherits the property upon the other owner’s death.

- Establish a Revocable Living Trust: Transferring the house into a living trust can avoid probate entirely.

- Utilize TOD Deeds: This option allows for direct transfer of the property to a designated beneficiary upon death.

Conclusion

Probate is a crucial legal process that ensures the proper distribution of a deceased individual’s estate, including their house. While it can be a complex and time-consuming process, it offers essential safeguards for beneficiaries, creditors, and the deceased’s estate. By understanding the intricacies of probate and exploring potential alternatives, individuals can proactively plan for the future and minimize the legal complexities associated with the passing of a loved one.

Closure

Thus, we hope this article has provided valuable insights into The Probate Process: Understanding When a House Requires Legal Administration. We appreciate your attention to our article. See you in our next article!