The Probate Process and Real Estate: When Does a Home Need to Be Included?

Related Articles: The Probate Process and Real Estate: When Does a Home Need to Be Included?

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Probate Process and Real Estate: When Does a Home Need to Be Included?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Probate Process and Real Estate: When Does a Home Need to Be Included?

The death of a loved one often brings a complex web of legal and financial considerations. One crucial aspect that frequently arises is the disposition of the deceased’s property, particularly real estate. This article will delve into the intricacies of probate, exploring when a home is subject to this legal process and the implications for beneficiaries and heirs.

Understanding Probate: A Legal Framework for Estate Administration

Probate is the legal process by which a court oversees the distribution of a deceased person’s assets, known as their estate. This process ensures that the deceased’s wishes, as outlined in their will or by state intestacy laws, are carried out. Probate can be a straightforward or intricate procedure, depending on the complexity of the estate, the existence of a will, and any potential disputes among beneficiaries.

When Does a Home Enter the Probate Process?

A home is subject to probate when it is considered part of the deceased’s estate. This typically occurs in the following scenarios:

- The deceased owned the home individually: If the deceased held sole ownership of the property, it automatically becomes part of their estate and will be subject to probate.

-

The deceased owned the home jointly with another individual: If the deceased owned the property jointly with another person, the nature of the joint ownership determines whether the home will be subject to probate.

- Joint tenancy with right of survivorship: In this type of ownership, the surviving joint tenant automatically inherits the deceased’s share of the property, bypassing probate.

- Tenancy in common: In this type of ownership, the deceased’s share of the property becomes part of their estate and will be subject to probate.

- The deceased owned the home as a beneficiary of a trust: If the deceased owned the home as a beneficiary of a living trust, the property will generally not be subject to probate, as the trust governs its distribution.

Benefits of Probate for Real Estate

While probate can seem like a cumbersome process, it offers several important benefits for beneficiaries and heirs:

- Legal transfer of ownership: Probate ensures a legally valid transfer of ownership to the designated beneficiaries, protecting them from potential legal challenges and ensuring clear title to the property.

- Payment of debts and taxes: Probate allows for the payment of outstanding debts and taxes owed by the deceased, ensuring that creditors are fairly compensated and that the estate is not burdened by financial obligations.

- Protection of beneficiaries: Probate provides a framework for resolving disputes among beneficiaries, preventing potential conflicts and ensuring that the deceased’s wishes are respected.

- Formal distribution of assets: Probate provides a formal process for distributing assets to beneficiaries, ensuring that all rightful heirs receive their due share of the estate.

Circumstances Where a Home Might Avoid Probate

While probate is often necessary for real estate, certain circumstances may allow for a home to bypass this process:

- Joint tenancy with right of survivorship: As mentioned earlier, this type of ownership allows the surviving joint tenant to inherit the property directly, eliminating the need for probate.

- Transfer on death deed: This legal document allows the homeowner to designate a beneficiary who will inherit the property upon their death, avoiding probate.

- Living trust: If the deceased owned the home as a beneficiary of a living trust, the property will generally be distributed according to the trust’s terms, bypassing probate.

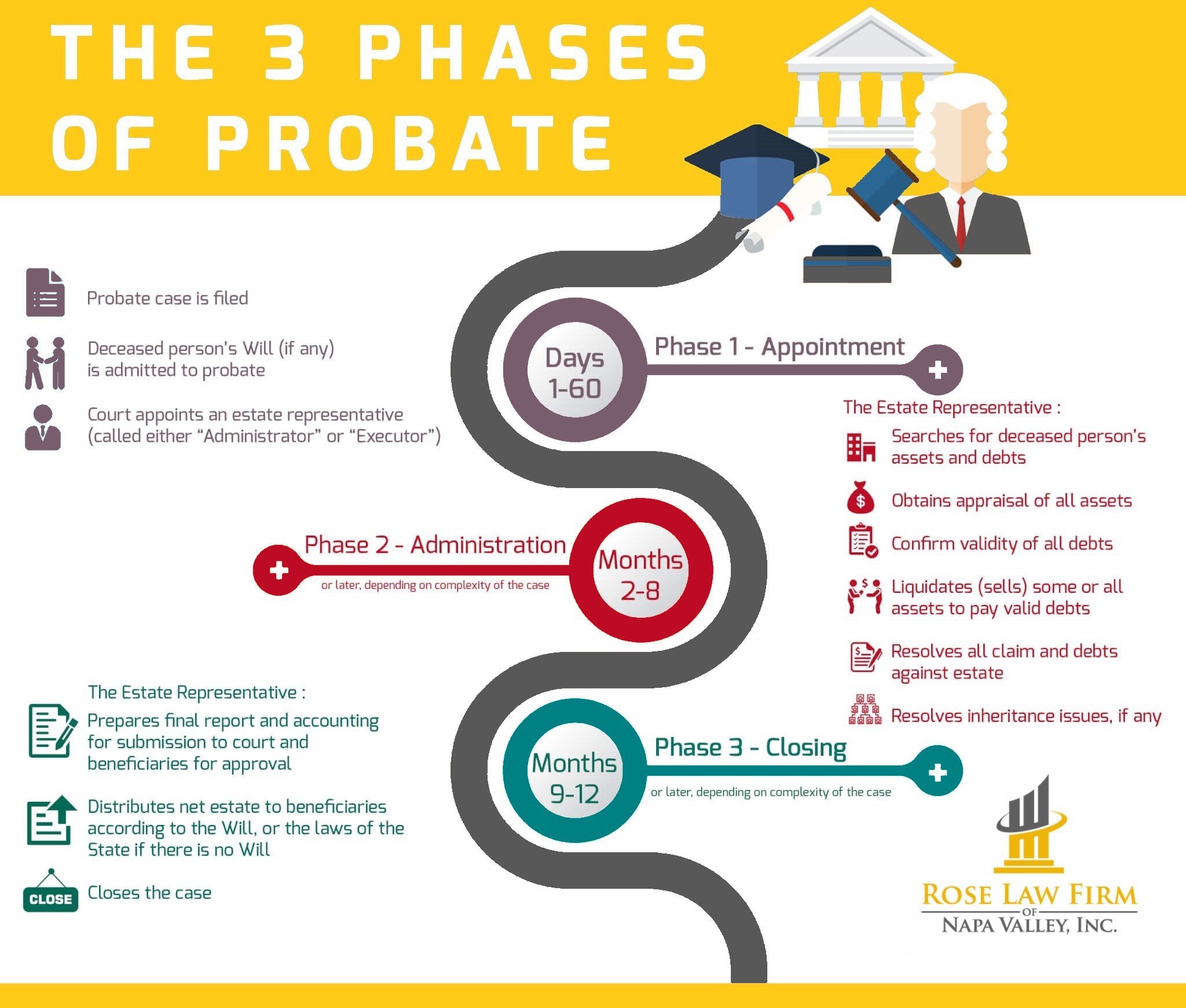

Understanding the Probate Process: A Step-by-Step Guide

The probate process typically involves the following steps:

- Opening the estate: The executor named in the will, or the administrator appointed by the court if there is no will, files a petition with the court to open the estate.

- Inventory and appraisal: The executor or administrator must inventory all assets of the estate, including the home, and have them appraised to determine their fair market value.

- Payment of debts and taxes: The executor or administrator pays any outstanding debts and taxes owed by the deceased from the estate’s assets.

- Distribution of assets: Once debts and taxes are paid, the executor or administrator distributes the remaining assets to the beneficiaries according to the terms of the will or state intestacy laws.

- Closing the estate: Once all assets have been distributed and all legal requirements have been met, the court closes the estate.

FAQs: Probate and Real Estate

1. What is the average cost of probate?

Probate costs vary depending on the size and complexity of the estate, the location of the property, and the legal fees charged by the executor or administrator. Generally, probate costs can range from a few hundred dollars to several thousand dollars.

2. How long does the probate process take?

The duration of the probate process can vary widely, ranging from a few months to several years, depending on the complexity of the estate and any potential disputes among beneficiaries.

3. Can I sell my home before probate is complete?

Selling a home before probate is complete can be complex and requires careful legal guidance. The executor or administrator must obtain court approval for the sale, and the proceeds from the sale will be subject to probate proceedings.

4. What happens if the deceased did not have a will?

If the deceased did not have a will, their estate will be distributed according to the intestacy laws of the state where they resided. These laws specify how assets will be divided among the deceased’s surviving spouse, children, and other relatives.

5. Can I avoid probate altogether?

While probate is often necessary, certain strategies can help minimize or avoid it altogether, such as owning property jointly with right of survivorship, establishing a living trust, or utilizing a transfer on death deed.

Tips for Navigating Probate and Real Estate

- Consult with an estate planning attorney: An experienced attorney can provide guidance on estate planning strategies, including the creation of a will or trust, to minimize the impact of probate on your real estate.

- Understand the types of joint ownership: Familiarize yourself with the different types of joint ownership and their implications for probate.

- Consider a transfer on death deed: This document can simplify the transfer of real estate ownership upon your death, avoiding probate.

- Keep accurate records: Maintain detailed records of your property ownership, debts, and other relevant financial information to streamline the probate process.

Conclusion

Probate is a legal process that ensures the orderly and fair distribution of a deceased person’s assets, including real estate. While it can seem complex, understanding the process and its implications can help beneficiaries navigate the legal and financial complexities associated with the inheritance of a home. By planning ahead and seeking professional guidance, individuals can minimize the impact of probate on their estate and ensure a smooth transition of ownership for their loved ones.

/what-is-probate-3505244-v3-5c07e7f746e0fb0001693ecf-8f024a9ead024bc796f36a02e1880768.jpg)

Closure

Thus, we hope this article has provided valuable insights into The Probate Process and Real Estate: When Does a Home Need to Be Included?. We thank you for taking the time to read this article. See you in our next article!