The Household Budget: A Comprehensive Guide to Managing Expenses

Related Articles: The Household Budget: A Comprehensive Guide to Managing Expenses

Introduction

With great pleasure, we will explore the intriguing topic related to The Household Budget: A Comprehensive Guide to Managing Expenses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Household Budget: A Comprehensive Guide to Managing Expenses

The household budget is the financial roadmap that guides individuals and families in navigating the complex landscape of everyday expenses. It is a crucial tool for financial stability, enabling individuals to make informed decisions about spending, saving, and investing. A well-structured budget empowers households to achieve their financial goals, whether it be purchasing a home, funding a child’s education, or ensuring a comfortable retirement.

This comprehensive guide delves into the intricacies of household budgeting, offering a detailed analysis of its components, benefits, and strategies for effective management.

Understanding the Components of a Household Budget

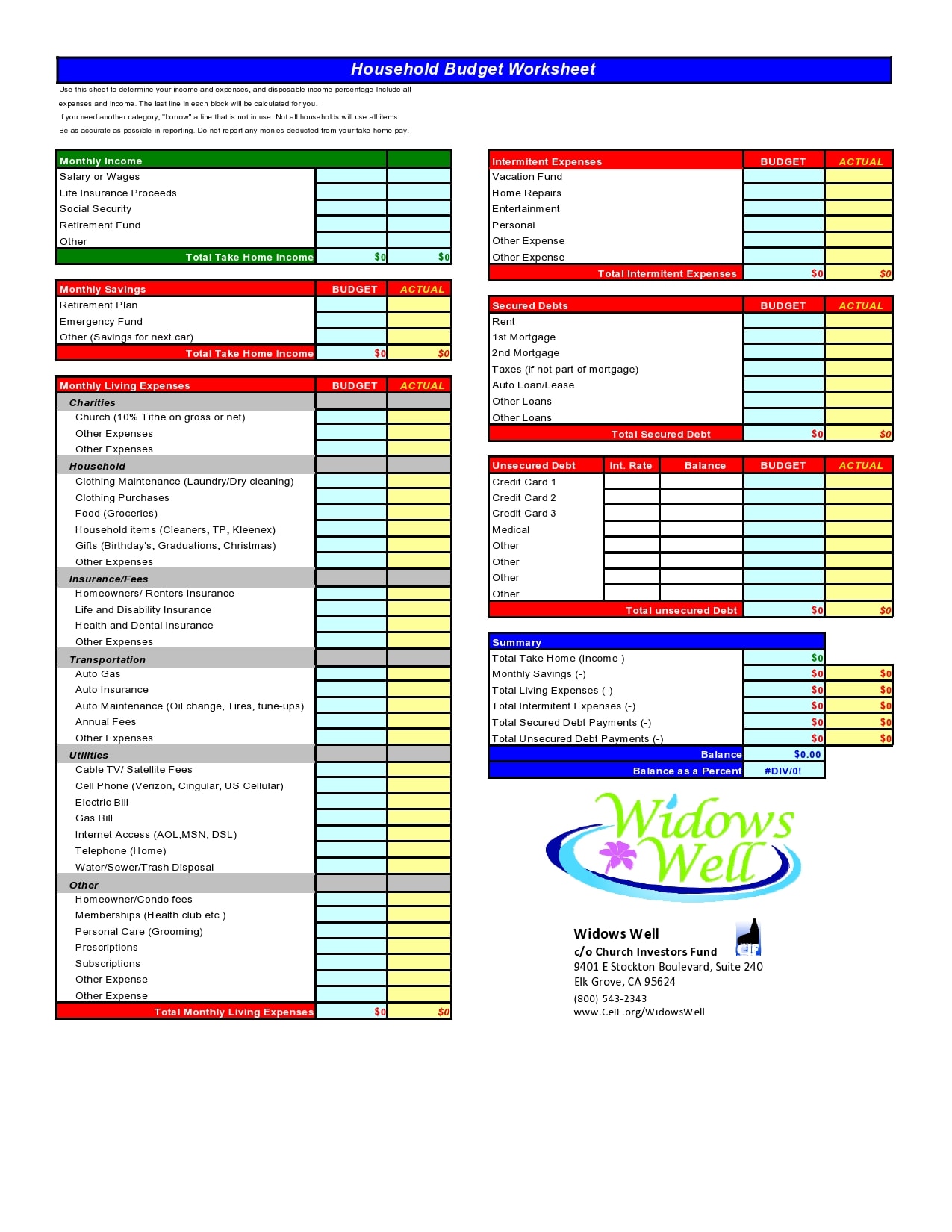

A household budget encompasses all income and expenses associated with a dwelling unit. It is a detailed accounting of all financial inflows and outflows, providing a clear picture of the household’s financial health. The key components of a household budget include:

1. Income:

- Employment Income: This represents the primary source of income for most households, encompassing salaries, wages, commissions, and bonuses.

- Investment Income: Returns on investments, such as dividends, interest, and capital gains, contribute to a household’s overall financial resources.

- Government Transfers: Social security payments, unemployment benefits, and other government assistance programs provide financial support to individuals and families.

- Other Income: This category encompasses a diverse range of income sources, including rental income, alimony, child support, and pensions.

2. Expenses:

- Housing: This is typically the largest single expense for most households, encompassing mortgage payments, rent, property taxes, homeowners insurance, and utilities.

- Transportation: Costs associated with vehicle ownership, including car payments, insurance, fuel, maintenance, and public transportation, contribute significantly to household expenses.

- Food: Groceries, dining out, and takeout meals constitute a substantial portion of household spending.

- Healthcare: Health insurance premiums, medical expenses, prescription drugs, and dental care contribute to the overall healthcare burden.

- Education: Tuition fees, books, supplies, and other educational expenses can be substantial, particularly for households with children.

- Personal Care: This category includes expenses related to clothing, toiletries, haircuts, and personal grooming.

- Entertainment: Leisure activities, such as movies, concerts, travel, and hobbies, contribute to discretionary spending.

- Savings: Allocating a portion of income to savings is crucial for achieving long-term financial goals.

- Debt Repayment: Payments on loans, credit cards, and other forms of debt are essential for maintaining financial stability.

Benefits of Creating and Maintaining a Household Budget

Establishing and consistently managing a household budget offers numerous benefits, including:

- Financial Clarity and Control: A budget provides a clear understanding of income and expenses, empowering individuals to make informed financial decisions.

- Improved Financial Discipline: Budgeting fosters financial discipline by encouraging conscious spending and reducing impulsive purchases.

- Goal Setting and Achievement: A budget facilitates the setting and achievement of financial goals, such as buying a home, paying off debt, or saving for retirement.

- Reduced Financial Stress: By providing a framework for managing finances, a budget can alleviate financial stress and anxiety.

- Financial Security: A well-managed budget promotes financial security by ensuring that essential expenses are covered and that savings are accumulated.

- Enhanced Financial Literacy: The process of creating and maintaining a budget fosters financial literacy, enabling individuals to make informed financial decisions.

Strategies for Effective Household Budgeting

Effective budget management requires a structured approach, incorporating the following strategies:

- Track Income and Expenses: Accurately recording all income and expenses is essential for creating a realistic budget.

- Categorize Expenses: Categorizing expenses into meaningful groups, such as housing, transportation, and food, facilitates analysis and identification of areas for potential savings.

- Develop a Budget Plan: Create a detailed budget plan that allocates income to various expenses, including savings and debt repayment.

- Prioritize Needs Over Wants: Distinguish between essential needs and discretionary wants, allocating resources accordingly.

- Negotiate and Shop Smart: Explore options for negotiating lower prices on essential goods and services, such as utilities, insurance, and healthcare.

- Utilize Budgeting Tools: Leverage budgeting apps and software to automate expense tracking, create financial reports, and set financial goals.

- Regularly Review and Adjust: Regularly review and adjust the budget as financial circumstances change, ensuring it remains relevant and effective.

FAQs about Household Budgeting

Q: How do I create a household budget?

A: To create a household budget, start by tracking your income and expenses for a month or two. Categorize your expenses, and then create a budget plan that allocates your income to various categories, including savings and debt repayment.

Q: What are some common budgeting mistakes?

A: Common budgeting mistakes include underestimating expenses, failing to track spending accurately, overspending on discretionary items, and not reviewing the budget regularly.

Q: How can I save money on my household expenses?

A: Explore options for reducing expenses in categories such as housing, transportation, food, and entertainment. Consider negotiating lower prices on utilities, insurance, and healthcare, and shop for deals on groceries and other essential items.

Q: What are some tips for budgeting with a family?

A: Involve all family members in the budgeting process, encourage open communication about financial goals, and prioritize needs over wants.

Conclusion

The household budget is an indispensable tool for financial well-being. It provides a framework for managing income and expenses, promoting financial discipline, and enabling individuals to achieve their financial goals. By embracing the principles of budgeting, individuals and families can gain control over their finances, reduce financial stress, and build a secure financial future.

Closure

Thus, we hope this article has provided valuable insights into The Household Budget: A Comprehensive Guide to Managing Expenses. We appreciate your attention to our article. See you in our next article!