Navigating the World of Household Items: A Comprehensive Guide to HS Codes

Related Articles: Navigating the World of Household Items: A Comprehensive Guide to HS Codes

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the World of Household Items: A Comprehensive Guide to HS Codes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Household Items: A Comprehensive Guide to HS Codes

The world of international trade is a complex tapestry, woven with regulations, tariffs, and classifications. One crucial element in this intricate system is the Harmonized System (HS) code, a standardized nomenclature used to categorize goods for customs and trade purposes. Within this framework, household items, the building blocks of our daily lives, find their place and significance.

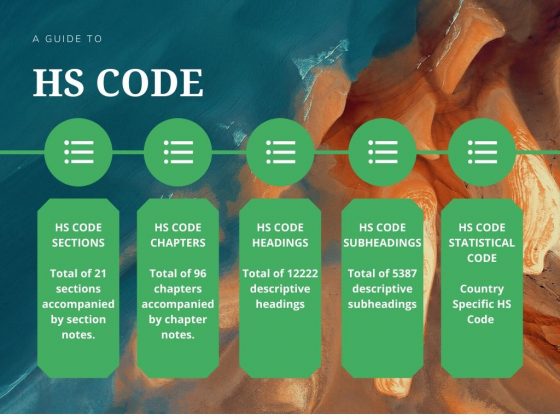

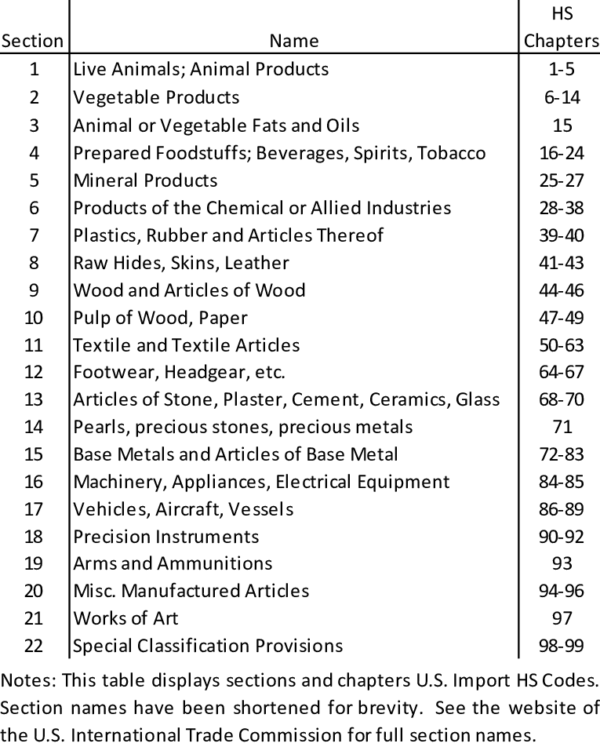

Understanding the HS Code System

The HS code system, established by the World Customs Organization (WCO), serves as a universal language for describing and classifying goods traded across international borders. It utilizes a six-digit numerical code structure, with each digit representing a specific characteristic of the product. These codes are hierarchical, meaning that broader categories are broken down into more specific subcategories as the digits progress.

Household Items and Their HS Codes

Household items encompass a vast array of products, from basic necessities like kitchenware and furniture to more specialized items like electronics and appliances. Each item, depending on its material, function, and purpose, falls under a specific HS code. Here are some examples of common household items and their corresponding HS codes:

Kitchenware:

- Knives, forks, and spoons: 8215.10.00

- Cookware (pots and pans): 7323.90.00

- Tableware (plates, bowls, cups): 7010.90.00

- Kitchen utensils (mixing spoons, whisks): 8215.90.00

Furniture:

- Wooden chairs: 9401.61.00

- Metal beds: 9403.20.00

- Sofas and armchairs: 9401.71.00

- Tables: 9401.69.00

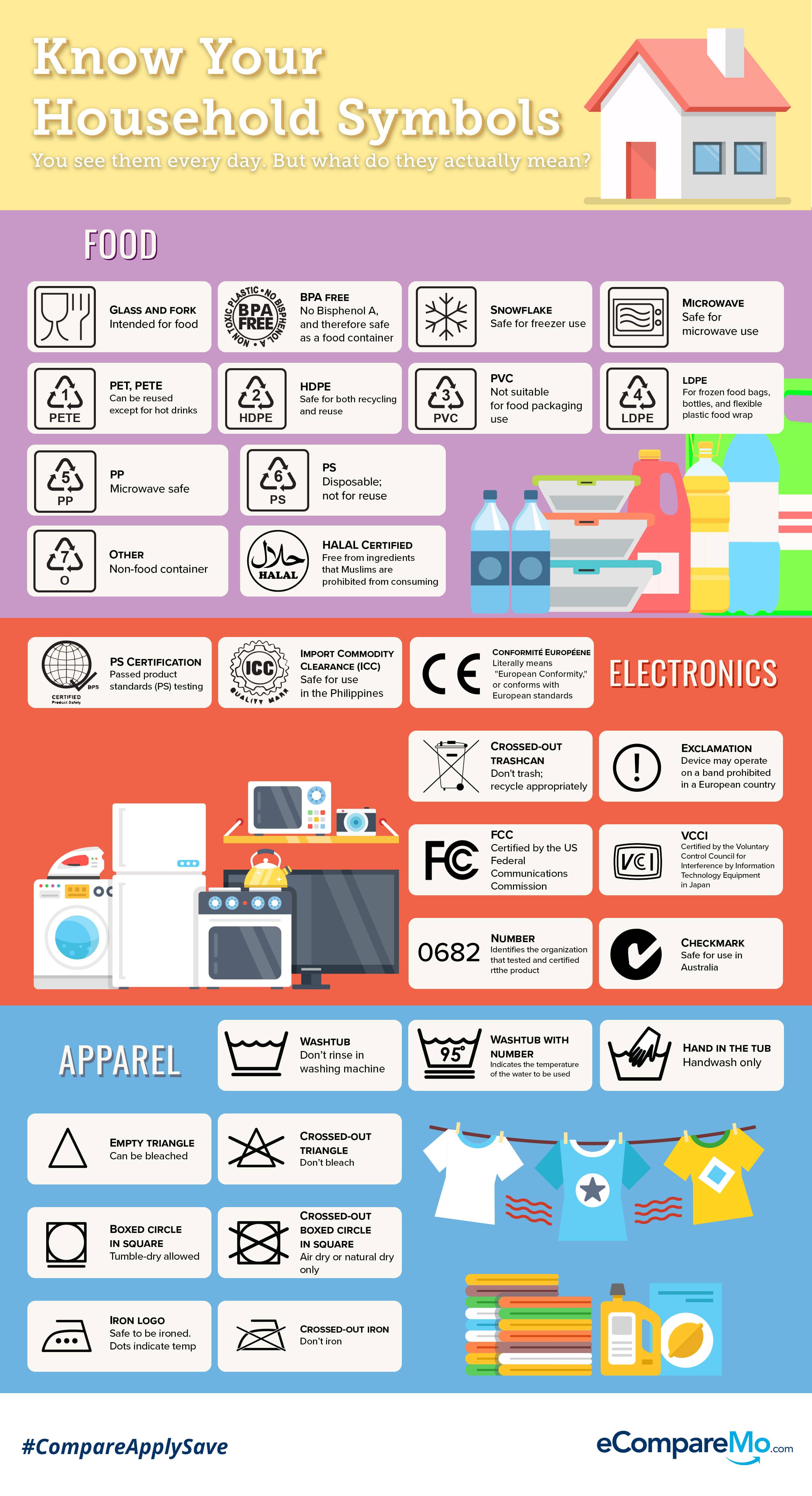

Electronics:

- Televisions: 8528.71.00

- Refrigerators: 8418.10.00

- Washing machines: 8422.11.00

- Computers: 8471.30.00

Appliances:

- Vacuum cleaners: 8508.10.00

- Air conditioners: 8415.10.00

- Electric fans: 8414.10.00

- Blenders: 8509.11.00

Textiles and Bedding:

- Cotton bed sheets: 6302.61.00

- Towels: 6302.30.00

- Blankets: 6302.91.00

- Curtains: 6303.91.00

The Importance of HS Codes

The HS code system plays a crucial role in international trade by:

- Facilitating Customs Clearance: By providing a standardized classification system, HS codes streamline the customs clearance process, ensuring efficient and accurate identification of goods.

- Determining Tariffs and Duties: Governments utilize HS codes to determine the applicable tariffs and duties on imported goods, enabling fair and transparent trade practices.

- Collecting Trade Statistics: HS codes are essential for collecting accurate trade statistics, providing valuable insights into global trade patterns and market trends.

- Simplifying Trade Documentation: HS codes simplify trade documentation, reducing paperwork and streamlining the overall trade process.

Benefits of Understanding HS Codes

For individuals and businesses involved in international trade, a comprehensive understanding of HS codes offers numerous benefits:

- Accurate Tariff Calculations: Knowing the correct HS code for your goods ensures accurate tariff calculations, minimizing the risk of unexpected costs.

- Smooth Customs Clearance: Accurate HS codes facilitate smooth customs clearance, reducing delays and potential disruptions to your supply chain.

- Informed Decision-Making: Understanding HS codes empowers you to make informed decisions regarding trade strategies, including product sourcing, pricing, and market entry.

- Competitive Advantage: A thorough knowledge of HS codes can provide a competitive advantage by enabling you to navigate trade regulations effectively and optimize your import/export operations.

FAQs about HS Codes and Household Items

Q1: How can I find the correct HS code for a specific household item?

A: Several resources can help you determine the correct HS code. The WCO website provides a comprehensive database of HS codes. Specialized databases and online tools, often offered by customs brokers and trade consultants, can also provide assistance.

Q2: Are there any exceptions or special rules for classifying household items?

A: Yes, certain household items may have specific classification rules or exceptions depending on their origin, material, or purpose. For example, antiques may have different classification rules than modern furniture.

Q3: What happens if I use the wrong HS code?

A: Using the wrong HS code can lead to delays in customs clearance, incorrect tariff calculations, and potential fines or penalties. It is crucial to ensure accuracy when determining the appropriate HS code.

Q4: How often are HS codes updated?

A: HS codes are updated periodically by the WCO to reflect changes in trade patterns, product development, and technological advancements.

Tips for Using HS Codes for Household Items

- Consult with Experts: If you are unsure about the correct HS code for a specific household item, seek guidance from customs brokers, trade consultants, or other experts in international trade.

- Verify the Code: Always double-check the accuracy of the HS code you have identified, using reliable sources like the WCO website or specialized databases.

- Stay Updated: Stay informed about any changes or updates to the HS code system to ensure you are using the most current and accurate information.

- Document Your Decisions: Maintain a record of the HS codes you have used for your household items, including the source of the information and the date of verification.

Conclusion

The HS code system plays a vital role in the global trade of household items. By providing a standardized classification system, it facilitates efficient customs clearance, determines tariffs and duties, and helps businesses make informed decisions regarding trade strategies. Understanding and utilizing HS codes correctly is crucial for businesses and individuals engaged in international trade, ensuring smooth operations and minimizing potential challenges. As the world of commerce continues to evolve, the importance of HS codes in the realm of household items will only grow, underscoring the need for continued awareness and expertise in this critical area of international trade.

![]()

![What is HS Code? HS Code Explained [UPDATED 2024]](https://tradefinanceglobal.com/wp-content/uploads/2022/04/hscode.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Household Items: A Comprehensive Guide to HS Codes. We appreciate your attention to our article. See you in our next article!