Navigating the World of Food Items: HSN Codes and GST Rates

Related Articles: Navigating the World of Food Items: HSN Codes and GST Rates

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the World of Food Items: HSN Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Food Items: HSN Codes and GST Rates

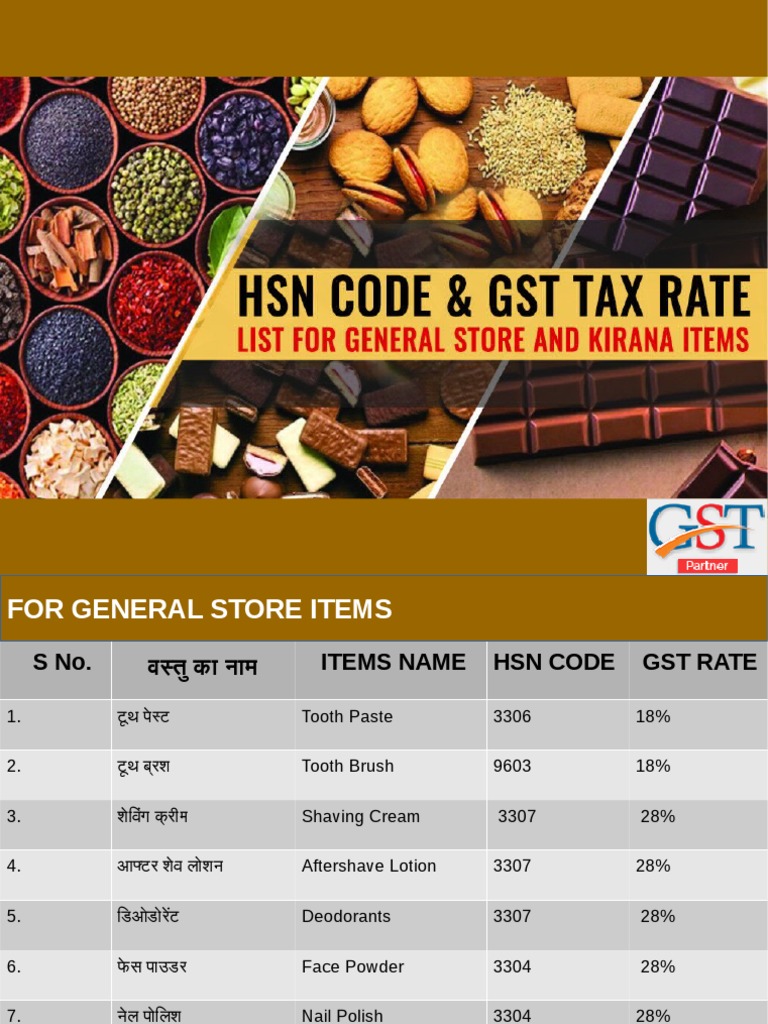

The Indian Goods and Services Tax (GST) system, implemented in 2017, has revolutionized the way goods and services are taxed in the country. This comprehensive tax regime aims to simplify the tax structure and promote a unified market. Within this framework, the Harmonized System Nomenclature (HSN) codes play a crucial role in classifying goods for taxation purposes.

HSN codes, a globally recognized system, are six-digit numerical codes that categorize various products based on their nature and characteristics. These codes are essential for identifying specific goods, facilitating trade, and ensuring uniform tax rates across the country.

In the context of food items, understanding HSN codes and GST rates is crucial for businesses and consumers alike. This article delves into the intricate world of food items, their corresponding HSN codes, and the applicable GST rates, offering a comprehensive guide to navigate this complex landscape.

A Glimpse into the Food Item Landscape:

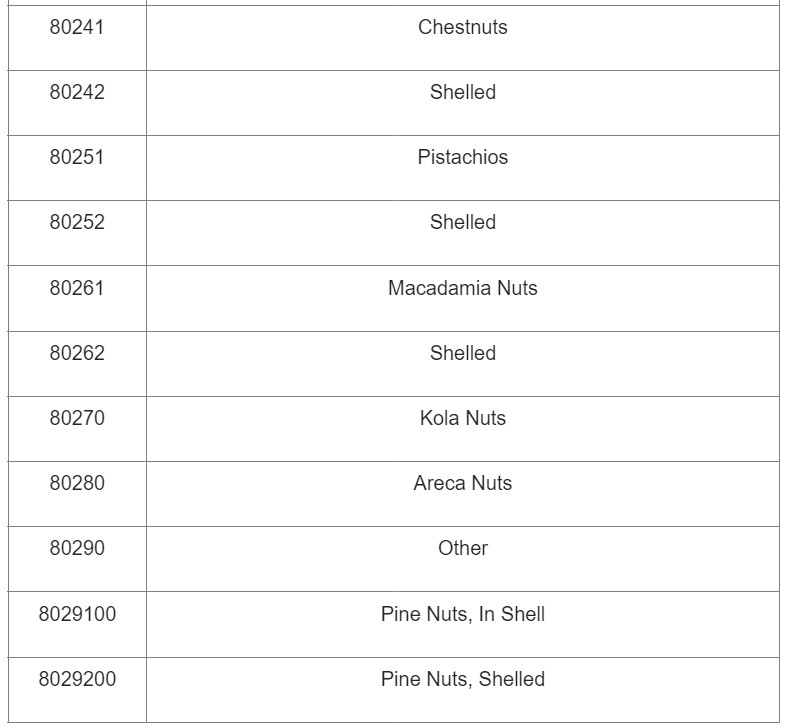

The food industry encompasses a vast array of products, ranging from basic staples to processed delicacies. These items are categorized under various HSN codes, each reflecting a specific type of food.

1. Cereals and Cereal Products (HSN Codes 1001-1009): This category includes essential staples like rice, wheat, maize, and barley. Processed cereal products like pasta, noodles, and breakfast cereals also fall under this umbrella.

2. Vegetables and Fruits (HSN Codes 0701-0714): Fresh, frozen, and preserved vegetables and fruits are classified under these codes. This includes a wide range of items, from tomatoes and potatoes to apples and mangoes.

3. Meat, Poultry, and Fish (HSN Codes 0101-0307): This category encompasses fresh, chilled, frozen, and processed meat, poultry, and fish products.

4. Dairy Products (HSN Codes 0401-0406): Milk, cheese, butter, yogurt, and other dairy products fall under this category.

5. Edible Oils and Fats (HSN Codes 1507-1518): This category includes various edible oils like sunflower oil, mustard oil, and olive oil, as well as animal fats.

6. Sugar and Sugar Confectionery (HSN Codes 1701-1704): Sugar, honey, and various sugar-based confectionery items are classified under these codes.

7. Beverages (HSN Codes 2201-2209): This category includes a wide range of beverages, from mineral water and fruit juices to tea and coffee.

8. Processed Food Products (HSN Codes 1601-1605, 1901-1905, 2001-2009, etc.): This category encompasses a vast array of processed food items, including canned goods, pickles, sauces, and ready-to-eat meals.

GST Rates on Food Items:

The GST rates on food items vary depending on the nature of the product. The majority of food items fall under the 5% GST slab, including staples like rice, wheat, pulses, vegetables, fruits, and dairy products. However, some food items are categorized under the 12% or 18% GST slab, depending on their nature and processing.

1. 5% GST: Most basic food items, including essential staples, fresh fruits and vegetables, milk, curd, and butter, are taxed at 5%.

2. 12% GST: Processed food items like biscuits, confectionery, packaged snacks, and certain beverages fall under the 12% GST slab.

3. 18% GST: Items like ice cream, chocolate, pizza, and other high-value processed food products are taxed at 18%.

Understanding the Importance of HSN Codes and GST Rates:

The HSN code system and corresponding GST rates play a crucial role in streamlining the Indian tax system. They offer several benefits, including:

- Clarity and Transparency: HSN codes provide a clear and standardized system for identifying and classifying goods, ensuring transparency in the tax system.

- Efficient Tax Collection: By categorizing goods based on their nature and characteristics, HSN codes enable efficient tax collection and reduce the scope for tax evasion.

- Harmonized Trade: The global adoption of the HSN system facilitates international trade by providing a common language for describing goods.

- Accurate Accounting: HSN codes help businesses maintain accurate accounting records, simplifying tax compliance and reducing administrative burden.

Navigating the HSN Code and GST Rate Landscape:

For businesses and consumers, understanding the HSN code and GST rate system is essential for navigating the complexities of the Indian tax system. Here are some key considerations:

- Accurate Identification: Businesses must accurately identify the HSN codes for all food items they deal with. This ensures correct GST calculation and compliance.

- GST Invoice Verification: Consumers should carefully check the GST invoice for the HSN code of the food item purchased. This helps verify the accuracy of the GST calculation and ensure that the correct tax rate is applied.

- Keeping Up-to-Date: The GST rates and HSN codes can be subject to change. It is essential to stay updated on any revisions or amendments announced by the government.

Frequently Asked Questions (FAQs):

1. How do I find the HSN code for a specific food item?

The HSN code for a specific food item can be found on the website of the Central Board of Indirect Taxes and Customs (CBIC). You can search for the item by its name or description.

2. What happens if I use the wrong HSN code?

Using the wrong HSN code can lead to penalties and fines. It is crucial to use the correct HSN code for all transactions.

3. Are there any exemptions from GST on food items?

Yes, some food items are exempt from GST, such as raw agricultural produce and basic staples like flour and rice.

4. How do I calculate GST on food items?

The GST on food items is calculated based on the applicable GST rate and the price of the item. The formula is: GST = Price of item x GST rate.

5. Can I claim input tax credit on GST paid on food items?

Businesses can claim input tax credit on GST paid on food items used for business purposes.

Tips for Effective HSN Code and GST Rate Management:

- Maintain a HSN code database: Create a comprehensive database of HSN codes for all food items you deal with. This will facilitate accurate GST calculation and compliance.

- Train employees: Ensure that all employees involved in purchasing, selling, and accounting for food items are well-versed in HSN codes and GST rates.

- Stay updated: Regularly check for any changes or updates to the HSN code system and GST rates.

- Consult experts: If you have any doubts or questions regarding HSN codes or GST rates, seek guidance from tax professionals.

Conclusion:

The HSN code and GST rate system is an integral part of the Indian tax landscape. Understanding this system is crucial for businesses and consumers alike. By accurately identifying HSN codes, applying the correct GST rates, and staying updated on any changes, businesses can ensure tax compliance and navigate the food item market with ease. Consumers, in turn, can be confident that they are paying the correct amount of tax and can make informed choices based on the GST rates applicable to different food items. This comprehensive understanding of the HSN code and GST rate system fosters a transparent and efficient tax environment, contributing to the overall growth and development of the Indian economy.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Food Items: HSN Codes and GST Rates. We thank you for taking the time to read this article. See you in our next article!