Navigating the Probate Process: Understanding Assets Subject to Administration

Related Articles: Navigating the Probate Process: Understanding Assets Subject to Administration

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Probate Process: Understanding Assets Subject to Administration. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Probate Process: Understanding Assets Subject to Administration

The passing of a loved one is a deeply personal and often challenging experience. Alongside the emotional complexities, there is the practical matter of managing the deceased’s estate. This process, known as probate, involves legally verifying the validity of a will, identifying and valuing assets, paying debts, and distributing the remaining property to beneficiaries. Not all assets are subject to probate, and understanding which ones are can significantly impact the estate’s administration. This article aims to provide a comprehensive overview of the types of assets typically subject to probate, outlining their importance and the intricacies of their management within the legal framework.

Defining Probate and Its Scope:

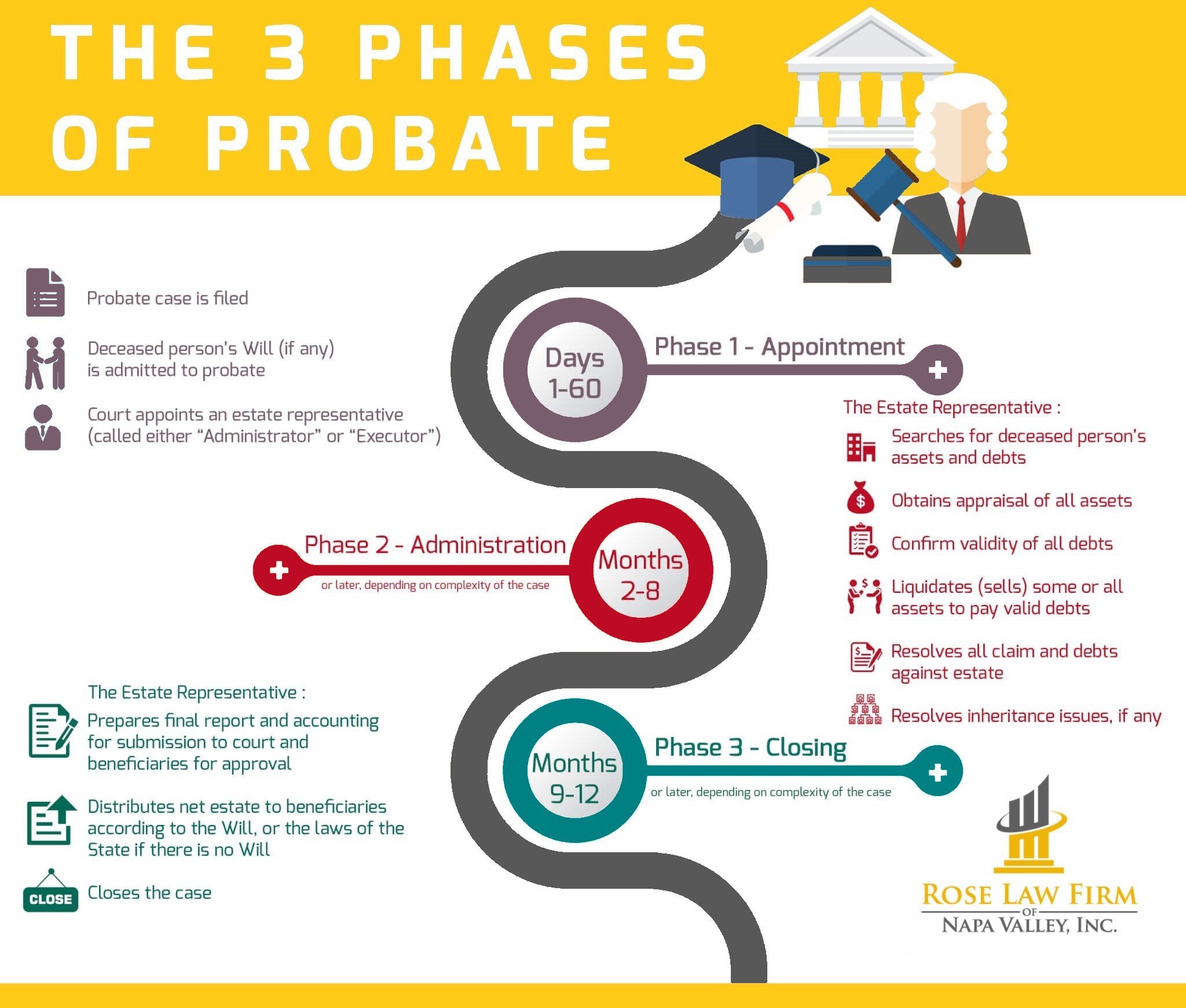

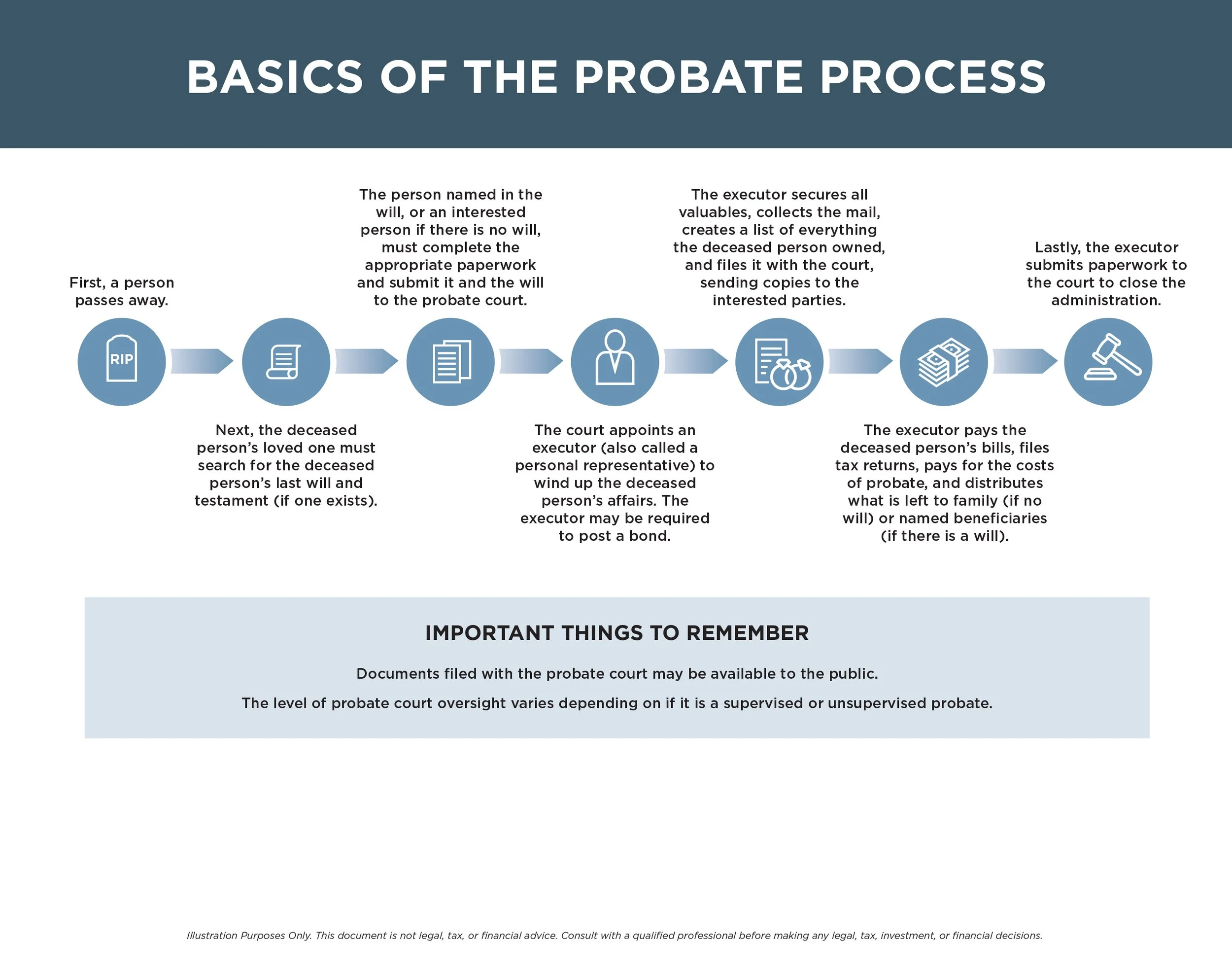

Probate is a court-supervised process that ensures the orderly and lawful distribution of a deceased person’s assets. It involves establishing the legal validity of a will, if one exists, and appointing an executor or administrator to manage the estate. The process is essential for ensuring the deceased’s wishes are respected and the rightful beneficiaries receive their inheritance.

Assets Subject to Probate:

The following assets are typically subject to probate, highlighting their significance in the estate administration process:

1. Real Estate:

Real estate, encompassing land and any structures built upon it, is often a substantial asset in an estate. Probate is necessary to legally transfer ownership of real estate to beneficiaries. This involves establishing clear title, paying any outstanding property taxes or liens, and ensuring proper documentation for the transfer.

2. Bank Accounts and Investments:

Financial accounts, including checking and savings accounts, as well as investments such as stocks, bonds, and mutual funds, are subject to probate. These assets are typically frozen upon death, and probate proceedings are required to release the funds to beneficiaries or distribute them according to the will’s provisions.

3. Vehicles:

Vehicles are considered personal property and are subject to probate. The probate process involves transferring ownership to the designated beneficiary, ensuring compliance with local vehicle registration regulations, and handling any outstanding loans or liens.

4. Personal Property:

This broad category encompasses a wide range of items, including furniture, jewelry, artwork, collectibles, and other possessions. While some personal property may be distributed informally among family members, probate is often necessary to ensure a fair and legal distribution, particularly for valuable items or when there are disputes among beneficiaries.

5. Intellectual Property:

Intellectual property rights, such as copyrights, patents, and trademarks, can hold significant value and are subject to probate. The process involves transferring these rights to the designated beneficiary, ensuring the proper legal documentation and safeguarding the intellectual property’s integrity.

6. Business Interests:

When a business owner passes away, their business interests are subject to probate. This involves determining the value of the business, paying off any outstanding debts, and transferring ownership to the designated beneficiary or liquidating the business according to the will’s instructions.

7. Life Insurance Policies:

While life insurance proceeds are generally not considered part of the estate, they can be subject to probate if the policy is payable to the estate. This typically occurs when the policy does not name a specific beneficiary or if the named beneficiary is deceased.

8. Retirement Accounts:

Retirement accounts, such as 401(k)s and IRAs, have specific rules governing their distribution upon death. While they are not directly subject to probate, the beneficiary designation determines how these funds are distributed. If there is no beneficiary designated or if the designated beneficiary is deceased, the funds may be subject to probate.

Exemptions from Probate:

It is important to note that certain assets are exempt from probate, meaning they are not subject to the court-supervised process. These include:

- Jointly Owned Property: Property held jointly with another person, such as a joint bank account or real estate owned as tenants in common or joint tenants with right of survivorship, passes directly to the surviving owner upon the death of the other owner.

- Beneficiary Designations: Assets held in accounts with beneficiary designations, such as life insurance policies or retirement accounts, are typically distributed directly to the named beneficiary upon death, bypassing probate.

- Small Estates: Some jurisdictions have provisions for small estate probate, allowing for simplified procedures and potentially avoiding the full probate process.

Importance of Probate:

Probate serves several crucial functions:

- Legal Validity of Will: Probate ensures the authenticity and legal validity of a will, preventing disputes and ensuring the deceased’s wishes are carried out.

- Asset Inventory and Valuation: Probate requires a comprehensive inventory and valuation of all estate assets, providing a clear picture of the estate’s financial standing.

- Debt Payment: Probate allows for the payment of outstanding debts and expenses, protecting the beneficiaries from financial burdens.

- Distribution of Assets: Probate ensures the orderly and legal distribution of assets to beneficiaries according to the will’s provisions or, in the absence of a will, according to the laws of intestacy.

Benefits of Probate:

While the probate process can be time-consuming and potentially costly, it offers significant benefits:

- Legal Protection: Probate provides legal protection for beneficiaries, ensuring they receive their rightful inheritance and safeguarding against potential fraud or disputes.

- Clarity and Transparency: Probate establishes a clear record of the estate’s assets, debts, and distribution, providing transparency and accountability.

- Tax Compliance: Probate helps ensure compliance with tax regulations, minimizing potential tax liabilities for the estate and beneficiaries.

FAQs Regarding Probate and Assets:

1. Is probate always necessary?

No, probate is not always necessary. Assets with beneficiary designations, jointly owned property, and small estates may be exempt from probate.

2. How long does probate take?

The duration of probate varies depending on factors such as the complexity of the estate, the jurisdiction’s laws, and the cooperation of parties involved. It can range from a few months to several years.

3. What are the costs associated with probate?

Probate costs include court fees, attorney fees, executor or administrator fees, and other expenses related to the administration of the estate.

4. Can I avoid probate?

While some assets can be exempt from probate, it is not possible to completely avoid probate if you have assets that are subject to it. However, proper estate planning, such as creating a will and establishing beneficiary designations, can minimize the need for formal probate proceedings.

5. What happens if there is no will?

If a person dies without a will, they are said to have died intestate. In this case, the state’s laws of intestacy will determine how the estate is distributed.

Tips for Managing Assets Subject to Probate:

- Consult with an Estate Planning Attorney: Seek professional legal advice to create a comprehensive estate plan that addresses your wishes and minimizes potential probate complications.

- Maintain Proper Documentation: Keep accurate records of all assets, including ownership documents, financial statements, and beneficiary designations.

- Consider Joint Ownership: For certain assets, consider joint ownership with right of survivorship to avoid probate.

- Establish Beneficiary Designations: Designate beneficiaries for life insurance policies, retirement accounts, and other assets to ensure their distribution according to your wishes.

- Stay Informed About Probate Laws: Familiarize yourself with the probate laws in your jurisdiction to understand the process and potential costs.

Conclusion:

Probate is an essential legal process for managing the assets of a deceased person, ensuring their wishes are honored and their estate is distributed fairly and lawfully. Understanding the types of assets subject to probate and the intricacies of the process is crucial for both estate planning and managing the estate after a loved one’s passing. By carefully considering estate planning options and seeking professional legal guidance, individuals can minimize the complexities and potential burdens associated with probate, ensuring a smooth and efficient transition for their beneficiaries.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Probate Process: Understanding Assets Subject to Administration. We thank you for taking the time to read this article. See you in our next article!