Navigating the Path to Homeownership with Less-Than-Perfect Credit

Related Articles: Navigating the Path to Homeownership with Less-Than-Perfect Credit

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Path to Homeownership with Less-Than-Perfect Credit. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership with Less-Than-Perfect Credit

The dream of homeownership is a powerful motivator for many, but the journey can be particularly challenging for individuals with less-than-perfect credit. However, with careful planning, strategic approaches, and a commitment to improvement, it is possible to overcome credit obstacles and achieve the goal of owning a home. This article provides a comprehensive guide to navigating the complexities of home buying with less-than-perfect credit, outlining actionable strategies and emphasizing the importance of persistence and informed decision-making.

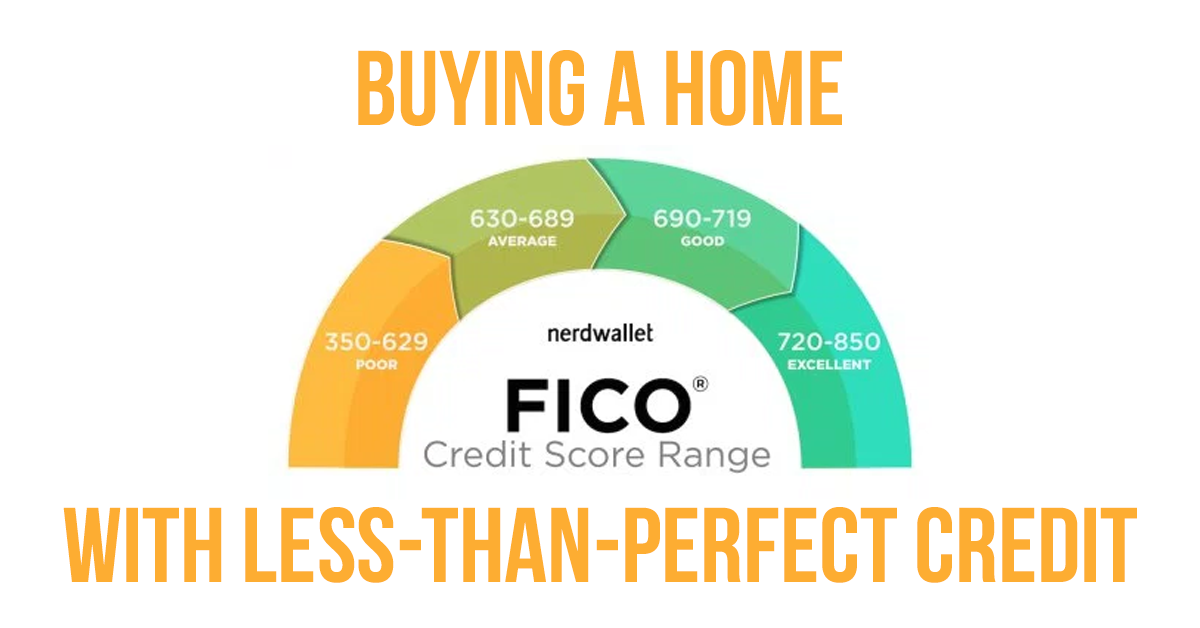

Understanding the Impact of Credit on Home Buying

Credit score plays a pivotal role in the home buying process. It is a numerical representation of an individual’s creditworthiness, reflecting their ability to manage debt responsibly. Lenders use credit scores to assess the risk associated with extending a mortgage loan. A higher credit score generally indicates a lower risk, leading to more favorable loan terms, such as lower interest rates and more competitive loan options. Conversely, a lower credit score can result in higher interest rates, stricter loan requirements, and potentially even loan denial.

Strategies for Improving Credit Score

Improving credit score is a crucial step in enhancing home buying prospects. The following strategies can contribute to a positive credit history:

- Pay Bills on Time: Consistent on-time payments demonstrate responsible financial management and have a significant impact on credit score. Automating payments or setting reminders can help ensure timely bill payments.

- Reduce Credit Utilization: Credit utilization ratio, calculated by dividing the amount of credit used by the total available credit, directly impacts credit score. Keeping this ratio below 30% is generally recommended.

- Limit New Credit Applications: Each new credit inquiry can slightly lower credit score. Avoid applying for multiple credit cards or loans within a short period.

- Dispute Errors on Credit Report: Mistakes or inaccuracies on credit reports can negatively affect credit score. Carefully review credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) and dispute any errors through the respective agencies.

- Consider a Secured Credit Card: Secured credit cards require a security deposit, which is used to cover potential debt. This can be a useful tool for building credit history, especially for individuals with limited credit history.

- Pay Down Existing Debt: Reducing outstanding debt balances can improve credit utilization and boost credit score. Prioritize paying down high-interest debt first.

Exploring Loan Options for Individuals with Less-Than-Perfect Credit

While conventional mortgages may be more challenging to secure with less-than-perfect credit, alternative loan options exist:

- FHA Loans: The Federal Housing Administration (FHA) offers mortgage insurance, which allows lenders to approve loans with lower credit score requirements. FHA loans typically have lower down payment requirements, making them more accessible to individuals with less-than-perfect credit.

- VA Loans: Veterans Affairs (VA) loans are available to eligible veterans, active-duty military personnel, and surviving spouses. These loans often have more lenient credit score requirements and do not require a down payment.

- USDA Loans: The United States Department of Agriculture (USDA) offers loans for rural properties. These loans can be particularly advantageous for individuals with lower credit scores, as they often have relaxed credit requirements.

- Private Loans: Private lenders may offer loans to borrowers with less-than-perfect credit, but these loans typically come with higher interest rates and stricter terms.

Tips for Finding a Lender and Securing a Mortgage

- Shop Around: Compare rates and terms from multiple lenders, including banks, credit unions, and mortgage brokers.

- Consider a Pre-Approval: Obtaining a pre-approval letter from a lender demonstrates financial readiness and can strengthen negotiating power during home searches.

- Focus on Down Payment: Saving for a larger down payment can compensate for a lower credit score, potentially making a loan more attractive to lenders.

- Be Transparent with Lenders: Honesty and transparency about credit history are crucial. Disclosing any credit challenges upfront allows lenders to assess the situation accurately and potentially offer suitable loan options.

- Improve Credit Score Before Applying: A higher credit score can significantly increase loan approval chances and potentially lead to more favorable loan terms.

Navigating the Home Buying Process with Less-Than-Perfect Credit

- Set Realistic Expectations: Understanding the challenges associated with less-than-perfect credit can help set realistic expectations and avoid disappointment.

- Work with a Real Estate Agent: A knowledgeable and experienced real estate agent can provide guidance throughout the home buying process, particularly in navigating the complexities of credit challenges.

- Consider a Home Inspection: A thorough home inspection can identify any potential issues that could impact the purchase decision. This is especially important for buyers with less-than-perfect credit, as they may have fewer options for renegotiating or backing out of a deal.

- Negotiate Effectively: A lower credit score may necessitate stronger negotiation skills to secure a favorable purchase price and loan terms.

- Be Prepared for Potential Delays: The loan approval process may take longer for individuals with less-than-perfect credit. Patience and persistence are essential.

Frequently Asked Questions (FAQs)

Q: What is a good credit score for buying a home?

A: While credit score requirements vary depending on the lender and loan type, a score of 620 or higher is generally considered good for obtaining a mortgage with favorable terms. However, even with a lower credit score, it may be possible to secure a loan, especially with alternative loan programs.

Q: Can I buy a home with a credit score below 620?

A: Yes, it is possible to buy a home with a credit score below 620, but it may be more challenging and require careful planning and strategic approaches. Exploring alternative loan options, improving credit score, and securing a larger down payment can increase the likelihood of approval.

Q: How long does it take to improve my credit score?

A: Improving credit score is a gradual process. Consistent efforts to pay bills on time, reduce debt, and manage credit utilization can lead to noticeable improvements over several months.

Q: What if I am denied a mortgage?

A: If a mortgage application is denied, it is essential to understand the reasons for denial. Lenders are required to provide a written explanation. This information can be used to address any credit challenges and improve chances of approval in the future.

Q: What are the benefits of homeownership?

A: Homeownership offers numerous benefits, including:

- Building Equity: As mortgage payments are made, equity in the property increases, providing financial security and potential future wealth.

- Tax Advantages: Homeowners can deduct mortgage interest and property taxes on federal income taxes, potentially reducing tax liability.

- Stability and Security: Owning a home provides a sense of stability and security, offering a place to call home for the long term.

- Pride of Ownership: Homeownership fosters a sense of pride and accomplishment, contributing to a feeling of personal fulfillment.

Conclusion

While home buying with less-than-perfect credit presents unique challenges, it is not an insurmountable obstacle. By understanding the factors that influence credit score, implementing strategies for improvement, exploring alternative loan options, and navigating the process with persistence and informed decision-making, individuals with less-than-perfect credit can achieve the dream of homeownership. The journey may require extra effort and careful planning, but the rewards of building equity, enjoying tax advantages, and establishing a stable home environment are well worth the endeavor.

![Your Journey to Homeownership [INFOGRAPHIC] - Christine Pervan Mid America Mortgage, Inc.](http://mtg-lady.com/wp-content/uploads/2021/11/20211119-MEM.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership with Less-Than-Perfect Credit. We hope you find this article informative and beneficial. See you in our next article!