Navigating the Legal Landscape: Understanding Probate and Its Impact on Real Estate

Related Articles: Navigating the Legal Landscape: Understanding Probate and Its Impact on Real Estate

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Legal Landscape: Understanding Probate and Its Impact on Real Estate. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Legal Landscape: Understanding Probate and Its Impact on Real Estate

The passing of a loved one is a deeply personal and often challenging experience. Alongside grief, families are frequently confronted with the complex process of settling the deceased’s affairs, including the disposition of their assets. Real estate, a significant component of many estates, often requires careful navigation through the legal framework known as probate.

Probate, essentially a court-supervised process, ensures that a deceased person’s assets are distributed according to their wishes as outlined in their will or, in the absence of a will, according to state law. This process involves identifying the deceased’s assets, paying outstanding debts, and ultimately transferring ownership to the rightful beneficiaries. Understanding when probate is necessary and its implications for real estate ownership is crucial for navigating this legal landscape.

When Does a House Need to Go Through Probate?

The need for probate depends on several factors, primarily the ownership structure of the property and the existence of a valid will.

-

Joint Ownership with Right of Survivorship: If the deceased owned the property jointly with another individual, and the ownership included the right of survivorship, the surviving owner automatically inherits the property. Probate is typically not required in this scenario, as the deceased’s interest in the property automatically passes to the surviving owner.

-

Sole Ownership with a Will: When a property is solely owned by the deceased and a valid will exists, the will outlines the distribution of the property. In this case, probate is generally necessary to formally transfer ownership to the designated beneficiary. The executor named in the will is responsible for managing the probate process and distributing the property according to the will’s instructions.

-

Sole Ownership Without a Will: In the absence of a will, the deceased is considered to have died "intestate." State laws dictate the distribution of the estate in such cases. Probate is usually required to determine the heirs and transfer ownership accordingly. The court appoints an administrator to oversee the process.

Understanding the Importance of Probate

Probate, while often viewed as a bureaucratic hurdle, plays a crucial role in ensuring the orderly and legal transfer of assets.

-

Legal Validity: Probate provides a legal framework for verifying the deceased’s ownership of the property and establishing the legitimacy of the intended beneficiaries. This legal confirmation is essential for protecting the rights of all parties involved.

-

Debt Settlement: Probate allows for the payment of outstanding debts and taxes owed by the deceased. This process ensures that creditors are appropriately compensated before assets are distributed to beneficiaries.

-

Fair Distribution: Probate ensures that the deceased’s wishes regarding the distribution of their assets are respected. In the absence of a will, probate ensures that the property is distributed according to state laws, preventing disputes and ensuring a fair outcome.

-

Protection of Assets: Probate safeguards the property from potential claims by individuals who may not have a legitimate claim to it. This legal process helps prevent disputes and ensures that the property is transferred to the rightful owner.

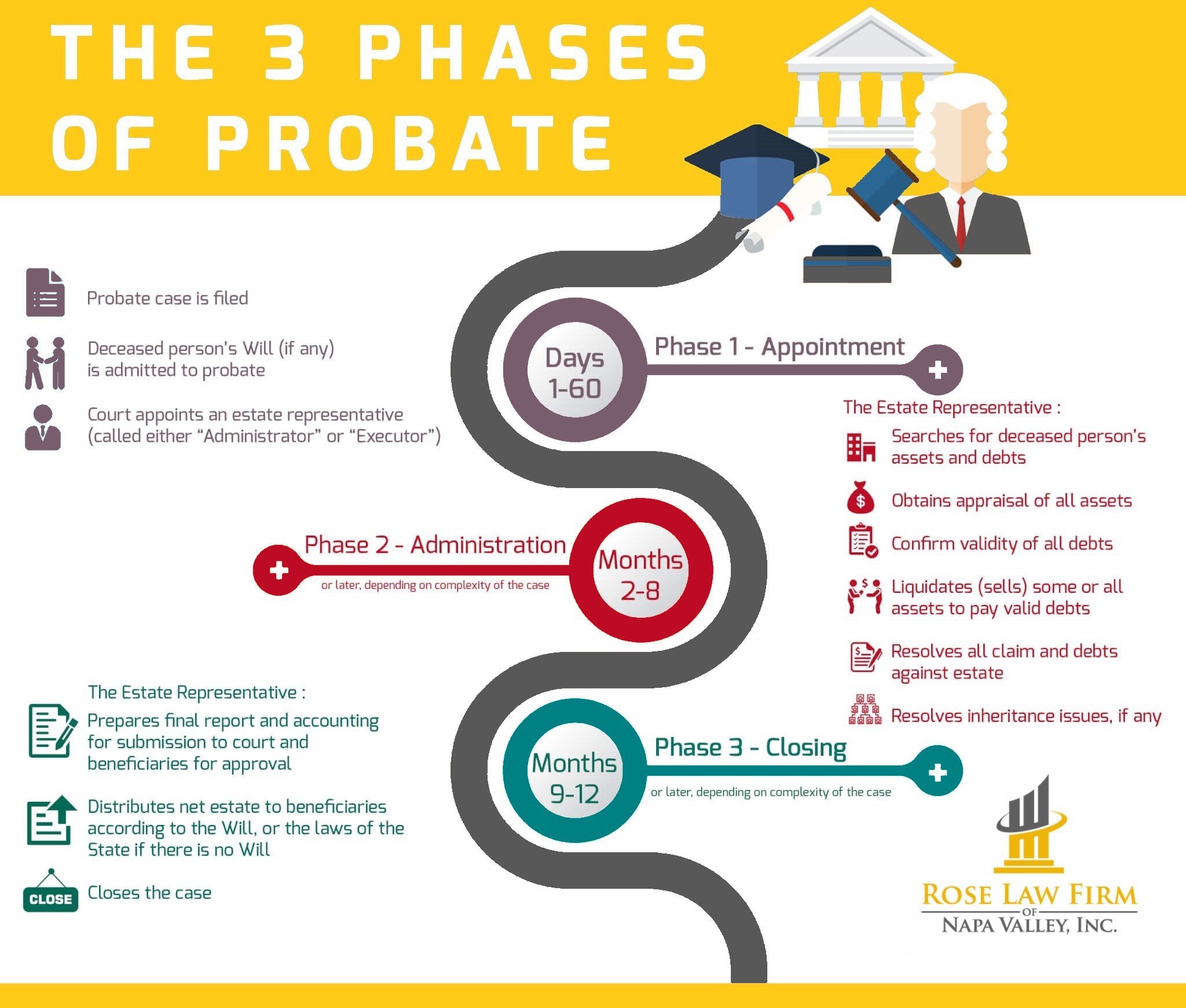

Probate: A Detailed Look at the Process

The probate process can vary depending on the complexity of the estate and the specific laws of the state. However, the general steps typically involve:

-

Opening Probate: The executor (if a will exists) or administrator (if no will exists) files a petition with the probate court to initiate the process.

-

Notice to Interested Parties: The court issues a notice to all potential beneficiaries, creditors, and other interested parties, informing them of the probate proceeding.

-

Inventory and Appraisal: The executor or administrator compiles an inventory of the deceased’s assets, including the real estate. These assets are then appraised to determine their fair market value.

-

Payment of Debts and Taxes: The executor or administrator pays outstanding debts and taxes owed by the deceased.

-

Distribution of Assets: Once debts and taxes are settled, the executor or administrator distributes the remaining assets to the beneficiaries according to the will or state law.

-

Closing Probate: Once all assets have been distributed and the estate is settled, the court closes the probate proceeding, officially transferring ownership of the property to the designated beneficiaries.

Probate and Real Estate: Potential Challenges

While probate is an essential process for ensuring legal ownership transfer, it can also present challenges, particularly for real estate:

-

Time-Consuming: The probate process can be lengthy, often taking several months or even years to complete, depending on the complexity of the estate and the court’s workload.

-

Legal Fees: Probate involves legal fees for the executor or administrator, as well as attorney fees for the beneficiaries. These fees can add up, especially for larger estates.

-

Public Records: Probate proceedings are public records, meaning that information about the deceased’s estate, including the property, becomes accessible to the public.

-

Potential Disputes: Disputes can arise between beneficiaries, creditors, or other interested parties regarding the distribution of assets. These disputes can delay the probate process and lead to additional legal costs.

FAQs Regarding Probate and Real Estate

Q: Can Probate Be Avoided for Real Estate?

A: In some cases, probate can be avoided for real estate. Joint ownership with right of survivorship, a properly executed transfer-on-death deed, or a living trust can all help avoid probate.

Q: How Can I Protect My Home from Probate?

A: Establishing a living trust can be an effective way to protect your home from probate. This legal document allows you to transfer ownership of your home to the trust during your lifetime, ensuring that it avoids probate upon your death.

Q: What Happens if There is No Will?

A: If there is no will, the state’s intestacy laws determine how the property is distributed. These laws typically favor the deceased’s spouse and children, but the specific distribution can vary depending on the state.

Q: How Long Does Probate Typically Take?

A: The duration of probate can vary significantly, depending on the complexity of the estate and the court’s workload. In some cases, probate can be completed within a few months, while in others it may take several years.

Q: What Are the Costs Associated with Probate?

A: The costs associated with probate can vary depending on the size and complexity of the estate. Fees include attorney fees, court fees, executor or administrator fees, and appraisal costs.

Tips for Avoiding Probate for Real Estate

-

Joint Ownership with Right of Survivorship: Consider adding a beneficiary to your property deed with right of survivorship. This ensures that the property automatically passes to the beneficiary upon your death, avoiding probate.

-

Transfer-on-Death Deed: This legal document allows you to designate a beneficiary to inherit your property upon your death. The beneficiary receives the property directly, bypassing probate.

-

Living Trust: A living trust allows you to transfer ownership of your property to the trust during your lifetime. Upon your death, the trust assets are distributed according to your instructions, avoiding probate.

Conclusion

Probate, while a necessary legal process for ensuring the orderly transfer of assets, can be complex and time-consuming. Understanding the implications of probate for real estate ownership is crucial for making informed decisions about estate planning. By taking proactive steps, such as establishing a living trust or utilizing joint ownership with right of survivorship, individuals can potentially avoid probate for their real estate, simplifying the process for their loved ones upon their passing. Consulting with a qualified estate planning attorney can provide personalized guidance and ensure that your wishes are properly documented and executed, protecting your legacy and ensuring a smooth transition for your beneficiaries.

/what-is-probate-3505244-v3-5c07e7f746e0fb0001693ecf-8f024a9ead024bc796f36a02e1880768.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Legal Landscape: Understanding Probate and Its Impact on Real Estate. We appreciate your attention to our article. See you in our next article!