Navigating the Landscape of Home Goods GST Rates: A Comprehensive Guide

Related Articles: Navigating the Landscape of Home Goods GST Rates: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape of Home Goods GST Rates: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Home Goods GST Rates: A Comprehensive Guide

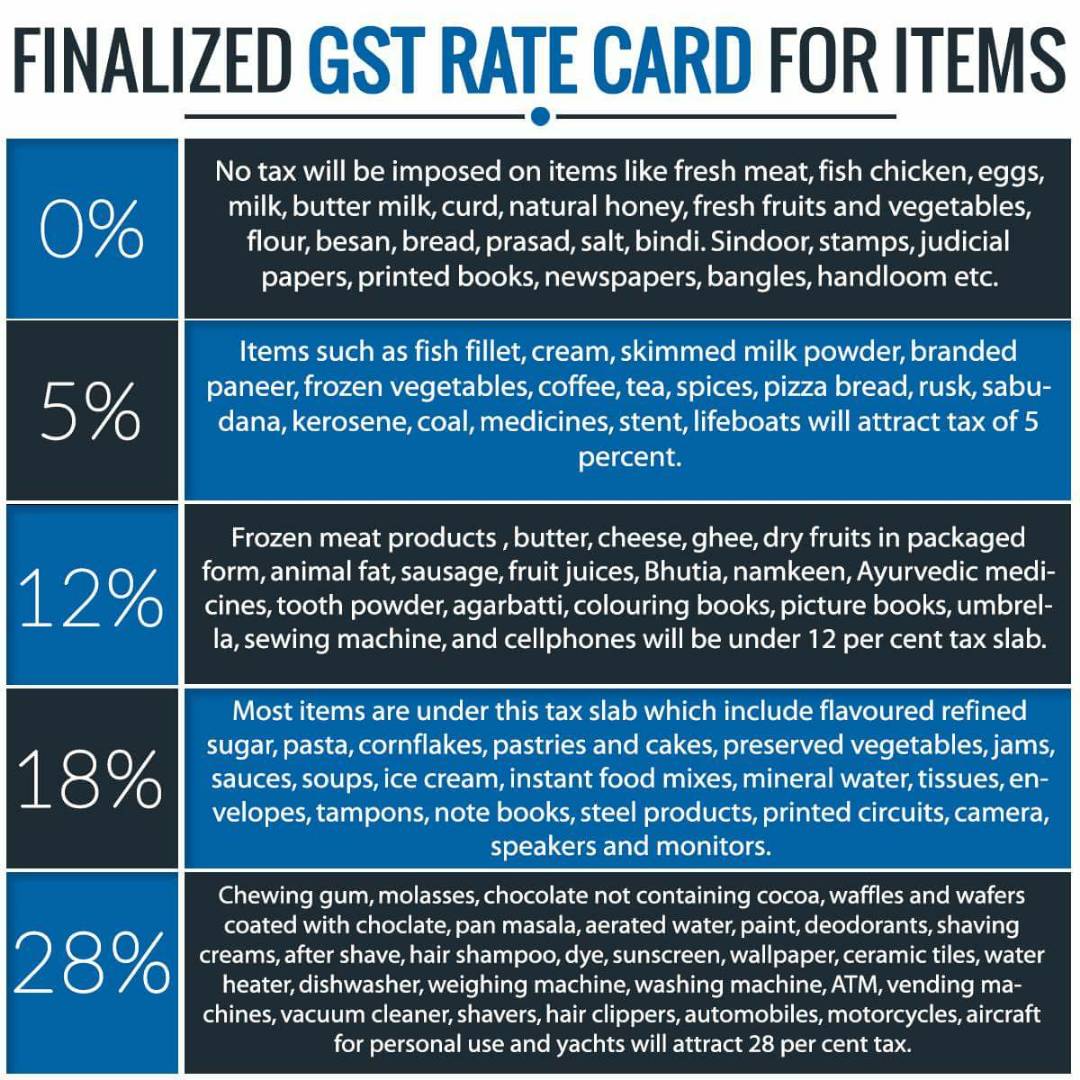

The Goods and Services Tax (GST) in India has significantly transformed the tax structure, streamlining processes and unifying rates for various goods and services. Within this framework, home goods occupy a prominent position, with specific Harmonized System (HSN) codes assigned to categorize them for tax purposes. Understanding these HSN codes and their corresponding GST rates is crucial for businesses and consumers alike. This article delves into the complexities of home goods HSN codes and their associated GST rates, offering a comprehensive guide for navigating this landscape.

Understanding HSN Codes and GST Rates:

The HSN code system is an internationally standardized nomenclature used to classify traded goods. In India, the GST regime utilizes this system to categorize goods and services, assigning specific HSN codes to each category. These codes are crucial for determining the applicable GST rate, which varies depending on the nature of the product and its classification.

Home Goods and Their HSN Codes:

Home goods encompass a wide array of items used in residential settings, ranging from furniture and appliances to decor and furnishings. Each category within this broad spectrum falls under specific HSN codes, which are further categorized into sub-categories for more precise classification.

Common Home Goods HSN Codes and GST Rates:

Here’s a breakdown of common home goods categories, their corresponding HSN codes, and the applicable GST rates:

1. Furniture:

-

HSN Code 9401: This code covers various types of furniture, including chairs, tables, beds, cabinets, and other seating or sleeping furniture. The GST rate for furniture under this code is typically 18%.

-

HSN Code 9402: This code specifically covers mattresses, bed bases, and other bedding furniture. The GST rate for these items is also generally 18%.

2. Appliances:

-

HSN Code 8516: This code covers various electrical appliances, including refrigerators, washing machines, dishwashers, and air conditioners. The GST rate for these appliances is typically 18%.

-

HSN Code 8517: This code encompasses electric ovens, stoves, and other cooking appliances. The GST rate for these appliances is generally 18%.

-

HSN Code 8518: This code covers water heaters, air purifiers, and other household appliances. The GST rate for these appliances is typically 18%.

3. Decor and Furnishings:

-

HSN Code 6307: This code covers carpets, rugs, and other floor coverings. The GST rate for these items is typically 12%.

-

HSN Code 6303: This code covers curtains, drapes, and other window coverings. The GST rate for these items is typically 12%.

-

HSN Code 9404: This code covers lamps, lighting fixtures, and other decorative items. The GST rate for these items is typically 18%.

4. Kitchenware and Tableware:

-

HSN Code 7323: This code covers cutlery, kitchen utensils, and other tableware made of metal. The GST rate for these items is typically 18%.

-

HSN Code 7010: This code covers glassware, including drinking glasses, tableware, and decorative items. The GST rate for these items is typically 18%.

-

HSN Code 3924: This code covers plastic tableware, kitchen utensils, and other household items. The GST rate for these items is typically 18%.

Factors Influencing GST Rates:

While the above table provides a general overview of GST rates for common home goods, it’s important to note that several factors can influence the actual rate applied:

-

Specific Product: The exact product within a category can affect the GST rate. For instance, a high-end designer chair might attract a different GST rate compared to a basic wooden chair.

-

Manufacturer/Importer: The origin of the product can also play a role. Imported furniture might face a higher GST rate compared to locally manufactured furniture.

-

Government Policies: The government can periodically revise GST rates based on economic conditions and policy decisions.

Importance of HSN Codes and GST Rates:

Understanding HSN codes and their associated GST rates is crucial for various stakeholders:

-

Businesses: Accurate classification of products based on HSN codes ensures correct GST calculation and payment, avoiding potential penalties and compliance issues.

-

Consumers: Knowing the GST rate allows consumers to make informed purchasing decisions, comparing prices across different brands and products.

-

Government: The HSN code system enables efficient tax collection and administration, providing valuable data for economic analysis and policy formulation.

FAQs on Home Goods HSN Codes and GST Rates:

1. What if a product doesn’t fit neatly into a specific HSN code?

In such cases, businesses can consult the GST Council’s guidelines or seek clarification from the tax authorities.

2. Are there any exemptions or special rates for certain home goods?

Yes, certain items, such as basic necessities like cooking gas and essential kitchenware, might fall under lower GST rates or exemptions.

3. How often are GST rates revised for home goods?

The GST Council periodically reviews and revises GST rates based on various factors, including economic conditions and policy changes.

4. Can I find a comprehensive list of HSN codes for home goods?

Yes, the GST Council’s official website and other reliable online resources provide detailed lists of HSN codes and their corresponding GST rates.

Tips for Navigating Home Goods HSN Codes and GST Rates:

-

Consult with Tax Professionals: Businesses should engage with qualified tax professionals to ensure accurate HSN code classification and GST compliance.

-

Stay Updated with GST Changes: Regularly monitor official government websites and industry publications for any updates or changes in GST rates and regulations.

-

Maintain Proper Documentation: Businesses should maintain detailed records of HSN codes, invoices, and GST payments for audit purposes.

-

Seek Clarification When Needed: Don’t hesitate to contact the tax authorities for clarification on any ambiguities or uncertainties related to HSN codes and GST rates.

Conclusion:

The HSN code system plays a vital role in the Indian GST regime, ensuring transparency, efficiency, and uniformity in tax calculation for home goods. By understanding the specific HSN codes and their associated GST rates, businesses and consumers can navigate this complex landscape effectively, ensuring compliance and making informed decisions. Staying updated with government announcements, consulting with tax professionals, and maintaining proper documentation are essential for navigating this evolving tax landscape.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Home Goods GST Rates: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!