Navigating the Landscape of Hardware Items: HSN Codes and GST Rates

Related Articles: Navigating the Landscape of Hardware Items: HSN Codes and GST Rates

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Hardware Items: HSN Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Hardware Items: HSN Codes and GST Rates

The world of hardware encompasses a vast array of products, from basic tools to complex machinery. Understanding the intricacies of Harmonized System (HS) codes and Goods and Services Tax (GST) rates applied to these items is crucial for businesses and individuals alike. This comprehensive guide delves into the classification, taxation, and implications of HSN codes and GST rates for various hardware products.

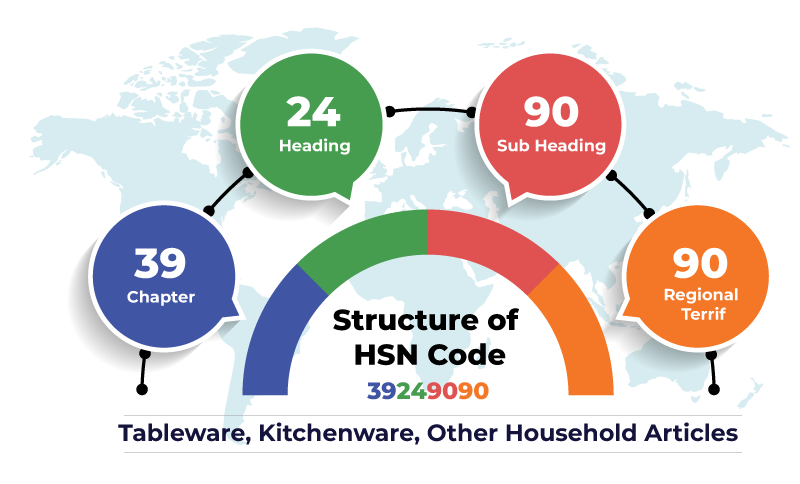

Understanding the Harmonized System (HS) Codes

The Harmonized System (HS) is an internationally standardized system for naming and classifying traded products. It provides a uniform language for customs and trade statistics worldwide. Each product is assigned a unique six-digit code, with additional digits added for more specific classifications within a country’s national tariff system.

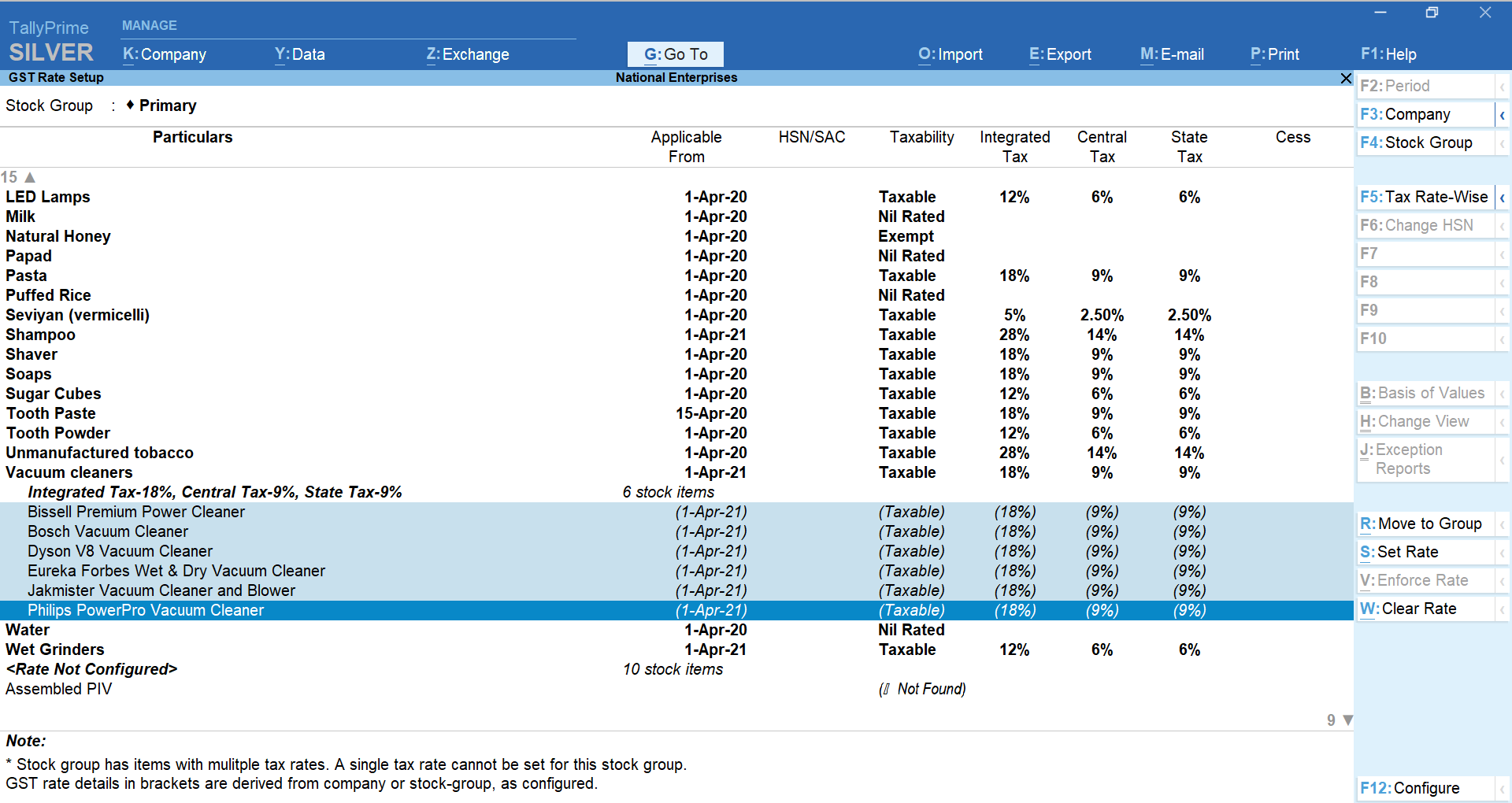

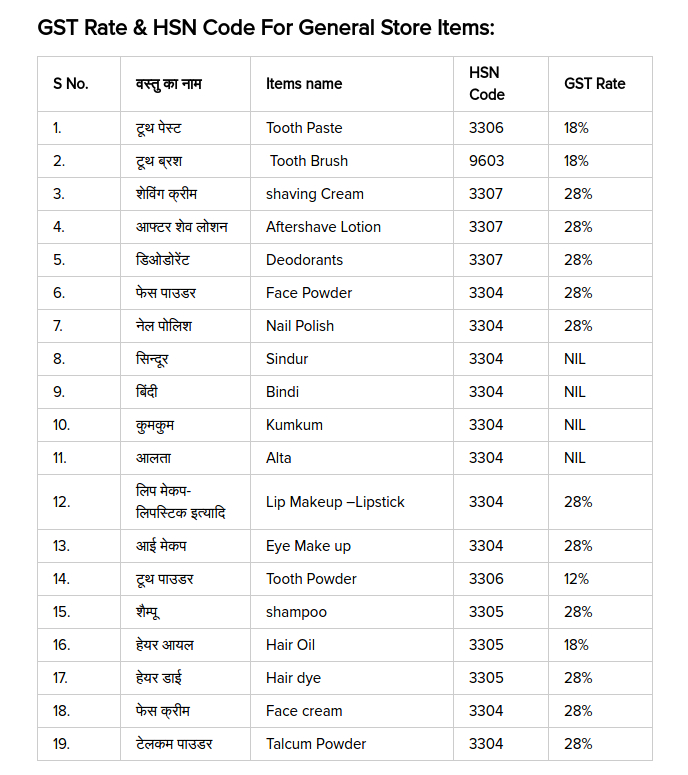

GST and Its Impact on Hardware Items

Goods and Services Tax (GST) is a value-added tax levied on the supply of goods and services in India. The rate of GST applicable to a particular hardware item depends on its HSN code. The GST Council, a body comprising representatives from the central and state governments, determines these rates.

Navigating the HSN Code and GST Rate Landscape

Here’s a breakdown of HSN codes and GST rates for common hardware items:

1. Hand Tools:

- HSN Code 8205.10.00: Hand tools, other than edge tools, for working wood, metal, stone or other materials, with wooden, plastic or metal handles. (GST Rate: 18%)

- HSN Code 8205.20.00: Hand tools, other than edge tools, for working wood, metal, stone or other materials, with other handles or without handles. (GST Rate: 18%)

- HSN Code 8205.30.00: Hand tools, other than edge tools, for working wood, metal, stone or other materials, hand-operated, with detachable blades or heads. (GST Rate: 18%)

- HSN Code 8205.40.00: Hand tools, other than edge tools, for working wood, metal, stone or other materials, hand-operated, other. (GST Rate: 18%)

2. Power Tools:

- HSN Code 8467.11.00: Electric drills, with a chuck diameter of less than 13 mm. (GST Rate: 18%)

- HSN Code 8467.19.00: Electric drills, other. (GST Rate: 18%)

- HSN Code 8467.21.00: Electric screwdrivers, with a chuck diameter of less than 13 mm. (GST Rate: 18%)

- HSN Code 8467.29.00: Electric screwdrivers, other. (GST Rate: 18%)

- HSN Code 8467.31.00: Electric saws, with a blade length of less than 400 mm. (GST Rate: 18%)

- HSN Code 8467.39.00: Electric saws, other. (GST Rate: 18%)

- HSN Code 8467.91.00: Electric grinding machines, with a wheel diameter of less than 150 mm. (GST Rate: 18%)

- HSN Code 8467.99.00: Electric grinding machines, other. (GST Rate: 18%)

3. Plumbing Supplies:

- HSN Code 7307.19.00: Pipes and tubes, of iron or steel, other. (GST Rate: 18%)

- HSN Code 7308.90.00: Fittings for pipes and tubes, of iron or steel, other. (GST Rate: 18%)

- HSN Code 3916.90.00: Pipes and tubes, of plastics, other. (GST Rate: 18%)

- HSN Code 3917.10.00: Fittings for pipes and tubes, of plastics, for water supply or sanitation. (GST Rate: 18%)

- HSN Code 3917.90.00: Fittings for pipes and tubes, of plastics, other. (GST Rate: 18%)

- HSN Code 6910.10.00: Sanitary ware, of ceramic, for toilets, urinals, sinks, washbasins, bathtubs, shower trays, etc. (GST Rate: 18%)

- HSN Code 6910.90.00: Sanitary ware, of ceramic, other. (GST Rate: 18%)

4. Electrical Supplies:

- HSN Code 8536.10.00: Electric wires and cables, insulated, other. (GST Rate: 18%)

- HSN Code 8536.20.00: Electric wires and cables, insulated, for telecommunications. (GST Rate: 18%)

- HSN Code 8536.30.00: Electric wires and cables, insulated, for aircraft. (GST Rate: 18%)

- HSN Code 8536.40.00: Electric wires and cables, insulated, for ships. (GST Rate: 18%)

- HSN Code 8536.50.00: Electric wires and cables, insulated, for vehicles. (GST Rate: 18%)

- HSN Code 8536.90.00: Electric wires and cables, insulated, other. (GST Rate: 18%)

- HSN Code 8537.10.00: Electric switches and sockets, for a voltage not exceeding 1,000 V. (GST Rate: 18%)

- HSN Code 8537.20.00: Electric switches and sockets, for a voltage exceeding 1,000 V. (GST Rate: 18%)

5. Building Materials:

- HSN Code 6801.00.00: Bricks, blocks, tiles and similar articles, of natural stone, for building or construction. (GST Rate: 18%)

- HSN Code 6802.00.00: Bricks, blocks, tiles and similar articles, of concrete, artificial stone or similar materials, for building or construction. (GST Rate: 18%)

- HSN Code 6804.10.00: Roofing tiles and sheets, of cement, asbestos-cement or similar materials. (GST Rate: 18%)

- HSN Code 6804.20.00: Roofing tiles and sheets, of other materials. (GST Rate: 18%)

- HSN Code 6807.10.00: Cement, other than Portland cement. (GST Rate: 18%)

- HSN Code 6807.21.00: Portland cement, other than white Portland cement. (GST Rate: 18%)

- HSN Code 6807.29.00: White Portland cement. (GST Rate: 18%)

6. Locks and Fittings:

- HSN Code 8301.10.00: Locks, padlocks, key blanks, other. (GST Rate: 18%)

- HSN Code 8301.20.00: Hinges, hasps and staples, other. (GST Rate: 18%)

- HSN Code 8301.30.00: Other fittings for doors, windows, shutters, blinds, etc. (GST Rate: 18%)

7. Fasteners:

- HSN Code 7318.11.00: Screws, bolts, nuts and washers, of iron or steel, other. (GST Rate: 18%)

- HSN Code 7318.15.00: Screws, bolts, nuts and washers, of iron or steel, for special uses. (GST Rate: 18%)

- HSN Code 7318.19.00: Screws, bolts, nuts and washers, of iron or steel, other. (GST Rate: 18%)

- HSN Code 7318.21.00: Rivets, of iron or steel, other. (GST Rate: 18%)

- HSN Code 7318.29.00: Rivets, of iron or steel, other. (GST Rate: 18%)

Understanding the Implications of HSN Codes and GST Rates

The HSN code and GST rate assigned to a hardware item have significant implications:

- Tax Liability: The GST rate determines the amount of tax payable on the sale of the product.

- Pricing: Businesses factor the GST rate into their pricing strategies, impacting the final cost for consumers.

- Import and Export: HSN codes are crucial for customs clearance and trade documentation during imports and exports.

- Inventory Management: Accurate HSN code classification helps businesses track inventory, manage stock levels, and streamline operations.

FAQs Regarding Hardware Items, HSN Codes, and GST Rates

Q1: How do I find the HSN code for a particular hardware item?

A1: The HSN code for a specific hardware item can be found in the Harmonized System Nomenclature published by the Directorate General of Foreign Trade (DGFT). Online resources like the GST portal and websites of tax consultants also provide searchable databases for HSN codes.

Q2: What happens if I use the wrong HSN code?

A2: Using an incorrect HSN code can lead to penalties and fines from tax authorities. It can also result in delays in customs clearance and incorrect calculation of GST liability.

Q3: Can the GST rate for a hardware item change?

A3: Yes, the GST rate for a particular hardware item can change depending on the decisions made by the GST Council. It’s essential to stay updated on any changes in GST rates.

Q4: Are there any exemptions from GST for hardware items?

A4: Certain hardware items may be exempt from GST, such as items used for specific purposes or supplied under specific conditions. Refer to the GST notification for details.

Q5: What are the benefits of using the correct HSN code for hardware items?

A5: Using the correct HSN code ensures accurate calculation of GST liability, smooth customs clearance, streamlined inventory management, and compliance with tax regulations.

Tips for Hardware Businesses Regarding HSN Codes and GST Rates

- Maintain Accurate Records: Keep detailed records of all hardware items purchased and sold, including their respective HSN codes and GST rates.

- Consult with Tax Experts: Seek guidance from tax consultants or chartered accountants to ensure correct HSN code classification and GST compliance.

- Stay Updated: Regularly check for changes in GST rates and HSN code classifications announced by the GST Council.

- Invest in Software: Utilize software solutions that integrate with GST and HSN code systems for efficient inventory management and tax calculations.

Conclusion

Navigating the complex landscape of hardware items, HSN codes, and GST rates requires careful attention and adherence to regulations. Understanding the intricacies of these systems is crucial for businesses and individuals involved in the hardware industry. By utilizing accurate HSN codes and staying informed about GST rates, stakeholders can ensure compliance, optimize operations, and navigate the complexities of taxation in the hardware sector.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Hardware Items: HSN Codes and GST Rates. We appreciate your attention to our article. See you in our next article!