Navigating the Grocery Aisle: Understanding HSN Codes and GST Rates

Related Articles: Navigating the Grocery Aisle: Understanding HSN Codes and GST Rates

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Grocery Aisle: Understanding HSN Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Grocery Aisle: Understanding HSN Codes and GST Rates

The grocery aisle, a familiar landscape for all, is a complex ecosystem when viewed through the lens of taxation. The Goods and Services Tax (GST) levied on various grocery items is determined by their Harmonized System Nomenclature (HSN) codes, a globally recognized system for classifying traded goods. Understanding these codes and their corresponding GST rates is crucial for both consumers and businesses in the grocery sector. This article aims to provide a comprehensive overview of HSN codes and GST rates for common grocery items, highlighting their importance and benefits.

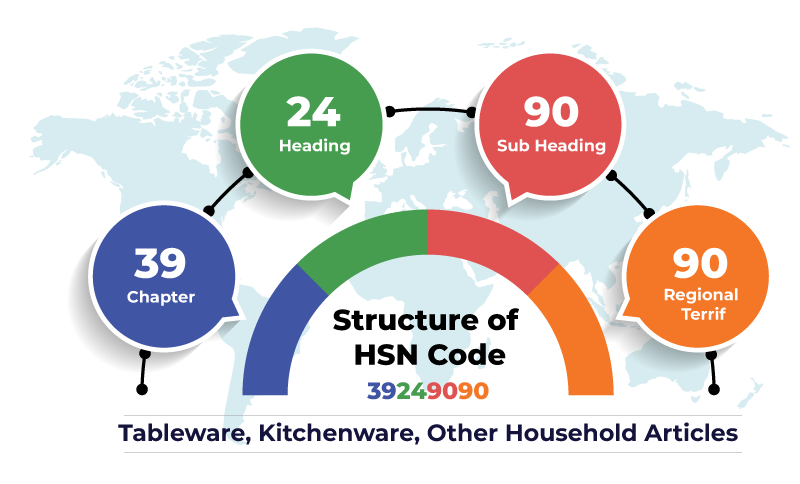

HSN Codes: A Universal Language for Trade

HSN codes are six-digit numerical codes that classify goods based on their characteristics and intended use. These codes are standardized internationally, facilitating trade and customs procedures worldwide. India adopted the HSN system in 1986, and it is an integral part of the GST regime.

GST Rates: A Spectrum of Taxation

GST, implemented in India in 2017, is a consumption-based tax levied on goods and services. The GST rate for a particular item is determined by its HSN code and falls into one of four categories:

- 5%: Essential commodities like unbranded food items, milk, and eggs.

- 12%: Non-essential items like packaged food, beverages, and processed food.

- 18%: Several processed food items, packaged goods, and certain beverages.

- 28%: Luxury items like aerated drinks, pan masala, and chocolates.

Decoding the Grocery Aisle: Common HSN Codes and GST Rates

Here’s a breakdown of HSN codes and GST rates for commonly consumed grocery items:

1. Cereals and Grains:

- HSN Code 1001.00: Wheat – GST Rate: 5%

- HSN Code 1002.00: Rice – GST Rate: 5%

- HSN Code 1003.00: Barley – GST Rate: 5%

- HSN Code 1004.00: Oats – GST Rate: 5%

- HSN Code 1005.00: Maize (Corn) – GST Rate: 5%

- HSN Code 1006.00: Rye – GST Rate: 5%

- HSN Code 1007.00: Millet – GST Rate: 5%

2. Pulses and Legumes:

- HSN Code 1001.90: Lentils – GST Rate: 5%

- HSN Code 1002.90: Chickpeas – GST Rate: 5%

- HSN Code 1003.90: Black Grams – GST Rate: 5%

- HSN Code 1004.90: Green Grams – GST Rate: 5%

- HSN Code 1005.90: Red Grams – GST Rate: 5%

3. Fruits and Vegetables:

- HSN Code 0701.00: Fresh Fruits – GST Rate: 5%

- HSN Code 0702.00: Fresh Vegetables – GST Rate: 5%

4. Dairy Products:

- HSN Code 0401.00: Milk – GST Rate: 5%

- HSN Code 0402.00: Yogurt – GST Rate: 5%

- HSN Code 0403.00: Cheese – GST Rate: 5% (Unbranded), 12% (Branded)

- HSN Code 0404.00: Butter – GST Rate: 5% (Unbranded), 12% (Branded)

5. Meat and Poultry:

- HSN Code 0201.00: Fresh Meat – GST Rate: 5%

- HSN Code 0202.00: Poultry Meat – GST Rate: 5%

6. Eggs:

- HSN Code 0407.00: Eggs – GST Rate: 5%

7. Oils and Fats:

- HSN Code 1507.10: Edible Vegetable Oils – GST Rate: 5%

- HSN Code 1507.90: Edible Animal Fats – GST Rate: 5%

8. Spices and Condiments:

- HSN Code 0910.00: Spices – GST Rate: 5%

- HSN Code 2101.00: Salt – GST Rate: 5%

9. Processed Foods:

- HSN Code 1901.10: Bread – GST Rate: 5%

- HSN Code 1901.90: Biscuits – GST Rate: 12%

- HSN Code 1902.00: Pasta – GST Rate: 12%

- HSN Code 1904.00: Cakes and Pastries – GST Rate: 18%

- HSN Code 1905.00: Confectionery – GST Rate: 18%

10. Beverages:

- HSN Code 2202.10: Bottled Water – GST Rate: 12%

- HSN Code 2203.00: Fruit Juices – GST Rate: 12%

- HSN Code 2204.00: Carbonated Drinks – GST Rate: 28%

- HSN Code 2205.00: Tea and Coffee – GST Rate: 18%

11. Packaged Goods:

- HSN Code 2106.90: Ready-to-eat Meals – GST Rate: 12%

- HSN Code 2103.00: Sauces and Ketchup – GST Rate: 18%

- HSN Code 2104.00: Jams and Jellies – GST Rate: 18%

- HSN Code 2105.00: Pickles and Chutneys – GST Rate: 18%

Understanding the Importance of HSN Codes and GST Rates

- Transparency and Fairness: HSN codes and GST rates ensure transparency and fairness in the taxation system. Consumers can understand the tax levied on each item, and businesses can comply with regulatory requirements.

- Accurate Price Calculation: GST rates are factored into the final price of goods, enabling consumers to make informed purchasing decisions.

- Streamlined Trade and Logistics: Standardized HSN codes simplify international trade and customs procedures, ensuring smooth movement of goods across borders.

- Revenue Generation: GST collected from various goods and services is a vital source of revenue for the government, funding public infrastructure and social welfare programs.

FAQs on Grocery Items HSN Codes and GST Rates

Q1: Where can I find the HSN codes and GST rates for specific grocery items?

A: The GST Council website, the official portal of the GST department, provides a comprehensive list of HSN codes and their corresponding GST rates. Additionally, many online resources and financial publications offer detailed information on HSN codes and GST rates for various goods.

Q2: Do HSN codes and GST rates vary for different brands of the same item?

A: Yes, the GST rate may differ for different brands of the same item based on factors like packaging, ingredients, and processing techniques. For example, unbranded milk typically attracts a 5% GST, while branded milk may be subject to a 12% GST rate.

Q3: How do I know if a particular item is subject to GST?

A: Most grocery items are subject to GST. However, some items, such as raw fruits and vegetables, are exempt from GST. Check the product packaging or consult the GST Council website for specific details.

Q4: Are there any exemptions from GST on grocery items?

A: Yes, certain essential commodities, such as unbranded food items, milk, eggs, and fresh fruits and vegetables, are exempt from GST. However, these exemptions may vary depending on the specific item and its packaging.

Q5: What are the implications of HSN codes and GST rates for businesses in the grocery sector?

A: Businesses need to understand and comply with the HSN codes and GST rates applicable to their products. Accurate classification of items ensures proper tax calculation and compliance with legal requirements.

Tips for Consumers: Navigating the Grocery Aisle with HSN Codes and GST Rates in Mind

- Be Aware of HSN Codes: Familiarize yourself with common HSN codes for grocery items to understand the tax levied on them.

- Compare Prices: Consider the GST rate while comparing prices for similar items from different brands.

- Check Packaging: Look for HSN codes and GST information on product packaging to make informed purchasing decisions.

- Consult Resources: Utilize online resources and financial publications to stay updated on HSN codes and GST rates for specific grocery items.

Conclusion

HSN codes and GST rates play a crucial role in the Indian grocery sector, ensuring transparency, fairness, and efficient tax collection. Understanding these codes and their implications is essential for both consumers and businesses. As the grocery industry continues to evolve, staying informed about HSN codes and GST rates is vital for making informed choices and navigating the complex landscape of taxation.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Grocery Aisle: Understanding HSN Codes and GST Rates. We appreciate your attention to our article. See you in our next article!