Navigating the Digital Landscape: A Guide to Electronic Items, HSN Codes, and GST Rates

Related Articles: Navigating the Digital Landscape: A Guide to Electronic Items, HSN Codes, and GST Rates

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Digital Landscape: A Guide to Electronic Items, HSN Codes, and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Digital Landscape: A Guide to Electronic Items, HSN Codes, and GST Rates

The world of electronics is vast and ever-evolving, encompassing a wide range of products from smartphones and laptops to televisions and home appliances. As a consumer or business involved in the trade of electronics, understanding the intricacies of Harmonized System (HS) codes and Goods and Services Tax (GST) rates is crucial for efficient operations and compliance. This comprehensive guide aims to demystify these concepts, providing a clear understanding of how they apply to electronic items.

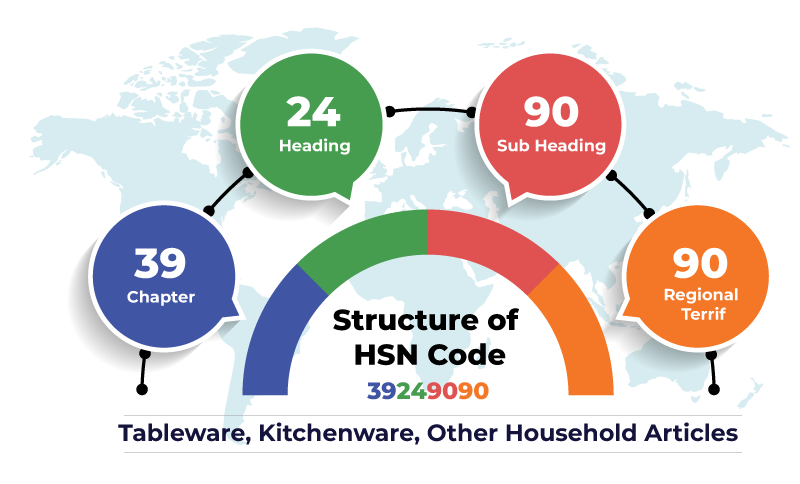

Understanding HSN Codes

The Harmonized System (HS) code is an internationally standardized system used to classify traded goods. It is a six-digit numerical code that provides a detailed description of a product’s nature and characteristics. HSN codes play a vital role in international trade, simplifying customs procedures and facilitating accurate data collection.

GST and its Relevance to Electronic Items

Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in India. It replaced a plethora of indirect taxes, simplifying the tax structure and ensuring a uniform tax rate across the country. GST rates for electronic items vary based on the specific HSN code assigned to the product.

Key Electronic Items and Their Corresponding HSN Codes and GST Rates

The following table outlines some key electronic items and their respective HSN codes and GST rates as of November 2023:

| Electronic Item | HSN Code | GST Rate |

|---|---|---|

| Mobile Phones | 8517.12.00 | 18% |

| Laptops | 8471.30.00 | 18% |

| Tablets | 8471.30.00 | 18% |

| Televisions | 8528.71.00 | 18% |

| Refrigerators | 8418.10.00 | 18% |

| Washing Machines | 8422.11.00 | 18% |

| Air Conditioners | 8415.10.00 | 18% |

| Microwave Ovens | 8516.71.00 | 18% |

| Digital Cameras | 8525.80.00 | 18% |

| Headphones | 8518.21.00 | 18% |

| Printers | 8443.10.00 | 18% |

| Computer Monitors | 8528.52.00 | 18% |

| Smartwatches | 8517.72.00 | 18% |

| Gaming Consoles | 9504.90.00 | 18% |

| Drones | 8803.20.00 | 18% |

Navigating the Complexity: Benefits and Importance

Understanding HSN codes and GST rates for electronic items offers numerous benefits, including:

- Accurate Pricing and Invoicing: Knowing the correct HSN code ensures accurate calculation of GST, leading to precise pricing and error-free invoicing.

- Streamlined Customs Clearance: Correctly classifying goods with HSN codes facilitates smoother customs clearance, reducing delays and associated costs.

- Enhanced Inventory Management: HSN codes enable efficient inventory management by providing a structured system for categorizing and tracking electronic items.

- Compliance with Tax Regulations: Understanding GST rates and their application ensures compliance with tax regulations, minimizing the risk of penalties and legal issues.

- Informed Purchasing Decisions: Awareness of GST rates empowers consumers to make informed purchasing decisions, considering the overall cost of electronic items.

Frequently Asked Questions

Q: How do I find the HSN code for a specific electronic item?

A: The HSN code for a specific electronic item can be found in the Harmonized System Nomenclature, which is available online through the website of the Central Board of Indirect Taxes and Customs (CBIC) or the World Customs Organization (WCO).

Q: Can the GST rate on electronic items change?

A: Yes, GST rates can be revised by the government from time to time. It is essential to stay updated on any changes to GST rates for electronic items.

Q: What are the implications of using an incorrect HSN code?

A: Using an incorrect HSN code can lead to inaccurate GST calculation, delayed customs clearance, and potential penalties.

Q: Where can I find information about GST rates for electronic items?

A: Information about GST rates for electronic items can be found on the website of the GST Council, CBIC, or other official government websites.

Tips for Efficient Management

- Maintain a Comprehensive HSN Code Database: Create a database of electronic items and their corresponding HSN codes for easy reference.

- Consult with Experts: If you are unsure about the correct HSN code for a specific item, consult with a tax expert or customs broker.

- Stay Updated on GST Rate Changes: Regularly check for any changes in GST rates for electronic items to ensure compliance.

- Utilize Online Resources: Leverage online resources such as the CBIC website and GST Council website for information on HSN codes and GST rates.

Conclusion

Understanding HSN codes and GST rates for electronic items is paramount for businesses and consumers alike. It ensures accurate pricing, streamlined customs clearance, and compliance with tax regulations. By leveraging the information provided in this guide, individuals and organizations can navigate the complex world of electronics with greater clarity and efficiency. Continued vigilance and proactive efforts to stay informed about changes in HSN codes and GST rates are essential for seamless operations in the dynamic electronics market.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Digital Landscape: A Guide to Electronic Items, HSN Codes, and GST Rates. We thank you for taking the time to read this article. See you in our next article!