Demystifying the GST HSN Code List: A Comprehensive Guide to Understanding Goods and Services Taxation in India

Related Articles: Demystifying the GST HSN Code List: A Comprehensive Guide to Understanding Goods and Services Taxation in India

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Demystifying the GST HSN Code List: A Comprehensive Guide to Understanding Goods and Services Taxation in India. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Demystifying the GST HSN Code List: A Comprehensive Guide to Understanding Goods and Services Taxation in India

The Goods and Services Tax (GST) regime in India, implemented in 2017, revolutionized the indirect tax landscape. A key element of this system is the Harmonized System (HS) Nomenclature, commonly known as the HSN code list. This comprehensive classification system serves as the backbone for identifying and categorizing goods and services, facilitating the seamless flow of information and accurate calculation of GST rates.

Understanding the HSN Code System

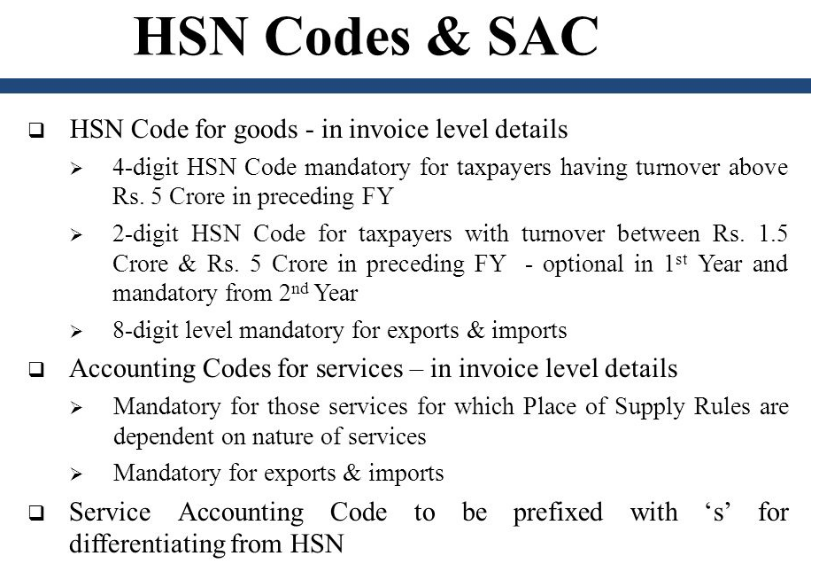

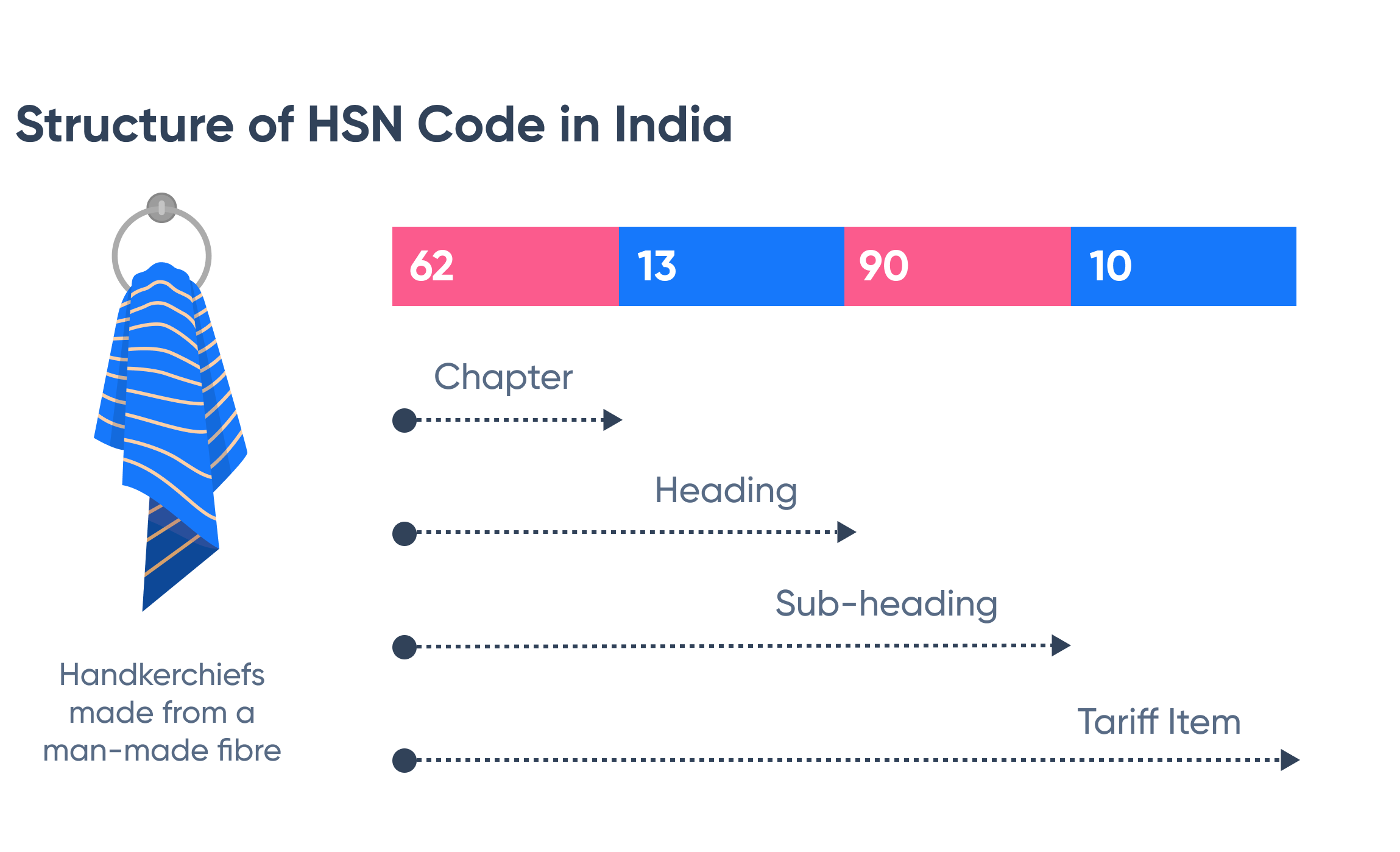

The HSN code list, adopted from the international Harmonized System, is a six-digit code structure that provides a standardized classification for over 5,000 product categories. Each digit in the code represents a specific level of detail, progressively narrowing down the product description. The first two digits represent the broadest category, while subsequent digits refine the classification, ultimately pinpointing the specific product or service.

GST Rates and the HSN Code List

The HSN code list plays a crucial role in determining the applicable GST rate for goods and services. The Indian government has assigned specific GST rates to various HSN codes, ranging from 0% to 28%. This rate structure is designed to encourage the consumption of essential goods while discouraging the consumption of luxury items.

Benefits of Using the HSN Code List

The HSN code list offers numerous benefits to businesses, taxpayers, and the government alike:

- Simplified Tax Compliance: The standardized HSN code system simplifies tax compliance by eliminating ambiguity and ensuring uniformity in classifying goods and services. This reduces the risk of disputes and facilitates smooth transactions.

- Streamlined Data Management: The HSN code list allows for efficient data management and analysis. Businesses can easily track their inventory, sales, and purchases, leading to improved decision-making and inventory control.

- Enhanced Transparency and Accountability: The HSN code system promotes transparency and accountability by providing a clear and consistent framework for classifying goods and services. This reduces the potential for tax evasion and fosters a more equitable tax system.

- Facilitation of Trade: The HSN code list facilitates international trade by providing a common language for classifying goods and services. This simplifies customs procedures and reduces the time and cost associated with international transactions.

Navigating the HSN Code List: A Practical Guide

Finding the appropriate HSN code for a specific product or service can sometimes be challenging. Here are some tips to navigate the HSN code list effectively:

- Consult the Official GST Website: The official GST website provides a comprehensive HSN code list with detailed descriptions and GST rates for each code.

- Utilize Online Resources: Several online platforms offer HSN code lookup tools and databases, simplifying the search process.

- Seek Professional Advice: If you are unsure about the correct HSN code for your product or service, consult with a tax professional or chartered accountant for assistance.

Frequently Asked Questions (FAQs)

Q1: What is the significance of the HSN code in GST?

A1: The HSN code is a fundamental aspect of the GST system in India. It serves as a standardized classification system for goods and services, facilitating accurate GST rate calculation, tax compliance, and data management.

Q2: How do I find the HSN code for my product or service?

A2: The official GST website, online HSN code lookup tools, and professional tax advisors can help you identify the appropriate HSN code for your product or service.

Q3: Can the HSN code change over time?

A3: Yes, the HSN code list is regularly updated to reflect changes in product classifications and GST rates. It is crucial to stay informed about any updates to ensure compliance.

Q4: What happens if I use the wrong HSN code?

A4: Using the incorrect HSN code can lead to penalties and disputes with the tax authorities. It is essential to use the appropriate HSN code for accurate tax calculation and reporting.

Q5: Are there any exemptions from using the HSN code?

A5: While the HSN code is mandatory for most goods and services, certain exemptions may apply based on the nature of the product or service. Consult the official GST website or a tax professional for details.

Conclusion

The HSN code list is an indispensable tool for navigating the complexities of the GST regime in India. By providing a standardized classification system for goods and services, it simplifies tax compliance, enhances data management, promotes transparency, and facilitates trade. Understanding and effectively utilizing the HSN code list is crucial for businesses, taxpayers, and the government to ensure a smooth and efficient GST implementation.

Closure

Thus, we hope this article has provided valuable insights into Demystifying the GST HSN Code List: A Comprehensive Guide to Understanding Goods and Services Taxation in India. We appreciate your attention to our article. See you in our next article!